Hey guys....newbie here.

I have a Roth 403b. My company allowed me to use the "rule of 55" exception to retire early. I met the criteria set forth by the IRS and I then retired at the age of 56.

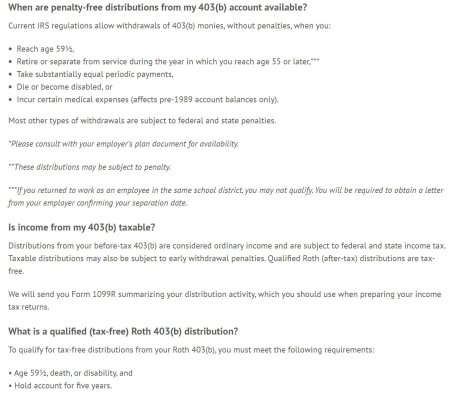

Here is my problem.. I made my first withdrawal of $30K from my account the other day. It was a money market account which has only returned about a half of one percent earnings in ten years. This means my earnings should have been negligible. Anyway...I never received a breakdown of the details in the mail or by email. When I received the check I was horrified that the fund administrator (not affiliated with my company) withheld over $3k (about 10%) from my distribution. I called them and they told me that the "age of 55 exception" does not apply to ROTH 403b accounts and that he is required by law to withhold 10% of the entire withdrawal. He called it "taxes" and not a "penalty".

Is this correct? Before I retired, I spoke sevetal times to other consultants from my fund management company and they informed me that I would not be subject to any 10% penalty or 10% taxes. I even clarified this with my company.

Anyway....does a Roth 403b allow for the "age of 55 exception" like the normal 403b does? Can someone reference the IRS rule or publication?

If not, shouldn't the fund manager have only withheld 10% of the "earnings" on my $30k withdrawal instead of the entire amount? If so...my earnings would be less than $150 which means they should have only withheld less than $15.

Anyway....thanks a bunch

I have a Roth 403b. My company allowed me to use the "rule of 55" exception to retire early. I met the criteria set forth by the IRS and I then retired at the age of 56.

Here is my problem.. I made my first withdrawal of $30K from my account the other day. It was a money market account which has only returned about a half of one percent earnings in ten years. This means my earnings should have been negligible. Anyway...I never received a breakdown of the details in the mail or by email. When I received the check I was horrified that the fund administrator (not affiliated with my company) withheld over $3k (about 10%) from my distribution. I called them and they told me that the "age of 55 exception" does not apply to ROTH 403b accounts and that he is required by law to withhold 10% of the entire withdrawal. He called it "taxes" and not a "penalty".

Is this correct? Before I retired, I spoke sevetal times to other consultants from my fund management company and they informed me that I would not be subject to any 10% penalty or 10% taxes. I even clarified this with my company.

Anyway....does a Roth 403b allow for the "age of 55 exception" like the normal 403b does? Can someone reference the IRS rule or publication?

If not, shouldn't the fund manager have only withheld 10% of the "earnings" on my $30k withdrawal instead of the entire amount? If so...my earnings would be less than $150 which means they should have only withheld less than $15.

Anyway....thanks a bunch