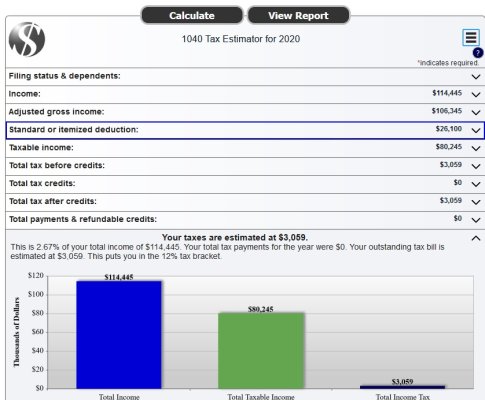

Yes, I am using Dinkytown to calculate my maximun Roth Conversion in the 12% bracket. It is a little convoluted for me because, I get next years expenses this year, I also have to generate a December $30k tuition payment. Add to those any taxes due and money for an HSA. Then add in the Roth Conversions which generate taxable income, so I have rerun the taxes due and generate more income to pay those extra taxes which also means more income and more taxes. But I have it pretty well figured out, although my first asset sale generated a several hundred dollars more LTCG than I calculated.What I would do, is using either the TurboTax What-If Worksheet or the dinkytown tax calculator is to sketch out 2020 tax assuming $0 Roth conversions. Then add Roth conversions to the top of the 12% bracket and compare the increase in tax to the amount of the conversion to get the effective rate on the conversion.

As noted, the harder part is to get an idea of your future tax rate before and after RMDs, but since SS and tax brackets grow with inflation and RMDs grow at at least the rate of inflation due to investment growth, I think you could get a rough approximation by using today's SS at the age you plan to take it (excluding COLA growth) and RMDs assuming you were now 72 (or maybe a little more).

I think I'll sneak up on the proper amount

with a bigger asset sale, redo the calculations to see how close I am and then one or two smaller asset sales to get it close.