Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

When people talk about their cash being a dead weight on the portfolio, I keep saying mine is not. Heh heh heh...

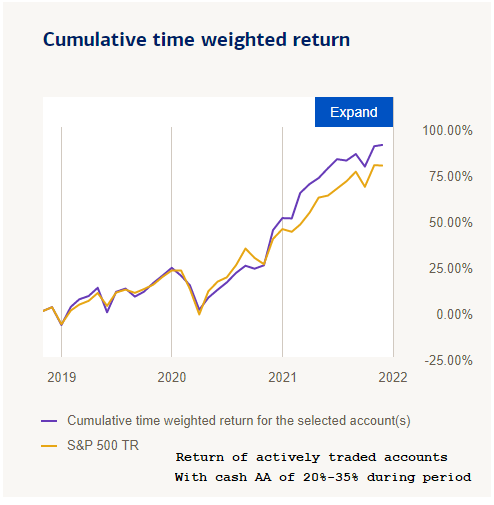

I usually commit about 10-30% of my cash, and the return when averaged over the entire cash portion is not bad at all. Heh heh heh...

Of course, there's risk and one has to know how to control it. Same as what I do, Running_Man and Sojourner only commit a portion of their cash to cover put options. And if the market drops 50%, we lose money, but it is still not as bad as someone who buys/holds the same stocks.

The stock buy-and-holder may win out when the stock goes to the moon. Maybe he will make 10x, while we only collect the small option premium. But then, I am not holding my entire stash in cash for writing put options. I own plenty of stocks too. Remember that I am only doing this on the cash portion of the portfolio, and then only on part of that cash.

And this is why I repeatedly said I don't bother to hold bonds. I think that bond return is low and the reward is lousy compared to the risk/reward of doing cash-covered put options. But then, this requires some market watching to sell options only on market down days. Yes, it takes some market timing.

PS. People will say, if it is so easy then why big investors don't do it. They know about all this, but being of their size, they cannot do the small hit-and-run that I do. They do big option and future trading on the S&P, but options of many individual stocks do not have the high volume for them to mess with.

It's like you can buy one or two foreclosed homes to flip, but that's peanuts for Buffett and he will have to look to buy an entire town and he cannot do that without people noticing.

Well stated!