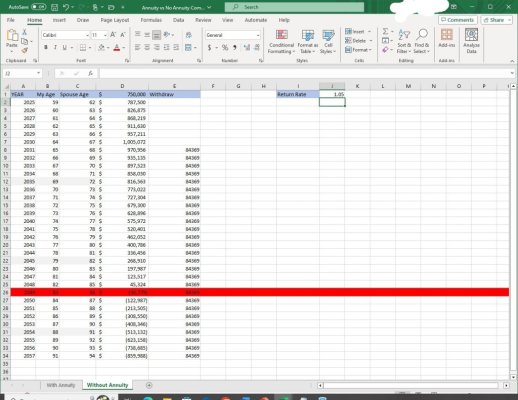

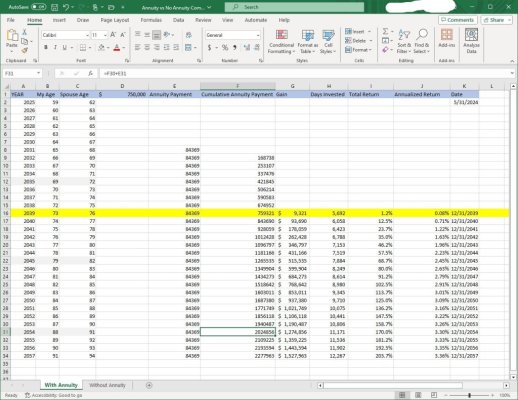

Note: If you don't read the entire post, take a look at the attached spreadsheet that illustrates two scenarios. 1) $750K initial investment (now) in a fixed index annuity with an income rider providing a guaranteed minimum payment of $84369 starting in 7 years. 2) Investment of $750K now earning 5% interest annually and withdraws of $84369 starting in 7 years. Notice how #2 runs out by the time I am 83 (7 yrs shy of end of plan). I need to earn >6% in the #2 scenario to make it to the end. This is just an illustration using 25% of the portfolio for the annuity. Now read on for more detail. Appreciate any comments.

Most of us are not fortunate enough nowadays for have a pension, and social security will not cover all of our expenses. Creating more guaranteed income (which a fixed index annuity can do with an income rider), is a way to eliminate some risk and deal with sequence of returns and bad timing. Annuities are not investments really, they are insurance policies.

I am not in any way a financial advisor. Just a dude with decent retirement savings trying to figure out how to make things work in retirement. You can talk all you want about bucket strategies, investing on your own, getting more return, but when you need to rely on that nest egg to fill a gap between Social Security and expenses, you are taking a lot of risk and may be in for some sleepless nights.

I created a simple spreadsheet for myself to cover 30 yrs in retirement for me and my spouse. Typical columns like inflation adjusted expenses (3%), medical expenses, social security at 70, savings balance, savings withdraws, taxes etc. I ran two scenarios, one with 25% of my starting portfolio used to purchase a fixed index annuity w/ income rider, and one with no annuity. The "no annuity" scenario only started to look more advantageous when I assumed an annual rate of return of 8% or higher on investment savings. Anything less than 8%, the with annuity scenario always looked better in terms of more assets at the end of plan and a lower withdraw rate from savings each year. By the way, I assumed the minimum payment withdraw from the income rider in the scenario. So, if any average investor foolishly assumes they can get 8% or higher without taking a lot of risk, and not hit bad timing and sequence of returns problems, then have at it.

That all said, I personally don't think it is ever a good idea to put all of your savings into an annuity. But, unless you are very wealthy, a portion may make sense. Shoot this down if you want to, but my spreadsheet is just simple math, it does not lie.

Most of us are not fortunate enough nowadays for have a pension, and social security will not cover all of our expenses. Creating more guaranteed income (which a fixed index annuity can do with an income rider), is a way to eliminate some risk and deal with sequence of returns and bad timing. Annuities are not investments really, they are insurance policies.

I am not in any way a financial advisor. Just a dude with decent retirement savings trying to figure out how to make things work in retirement. You can talk all you want about bucket strategies, investing on your own, getting more return, but when you need to rely on that nest egg to fill a gap between Social Security and expenses, you are taking a lot of risk and may be in for some sleepless nights.

I created a simple spreadsheet for myself to cover 30 yrs in retirement for me and my spouse. Typical columns like inflation adjusted expenses (3%), medical expenses, social security at 70, savings balance, savings withdraws, taxes etc. I ran two scenarios, one with 25% of my starting portfolio used to purchase a fixed index annuity w/ income rider, and one with no annuity. The "no annuity" scenario only started to look more advantageous when I assumed an annual rate of return of 8% or higher on investment savings. Anything less than 8%, the with annuity scenario always looked better in terms of more assets at the end of plan and a lower withdraw rate from savings each year. By the way, I assumed the minimum payment withdraw from the income rider in the scenario. So, if any average investor foolishly assumes they can get 8% or higher without taking a lot of risk, and not hit bad timing and sequence of returns problems, then have at it.

That all said, I personally don't think it is ever a good idea to put all of your savings into an annuity. But, unless you are very wealthy, a portion may make sense. Shoot this down if you want to, but my spreadsheet is just simple math, it does not lie.

Attachments

Last edited: