24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

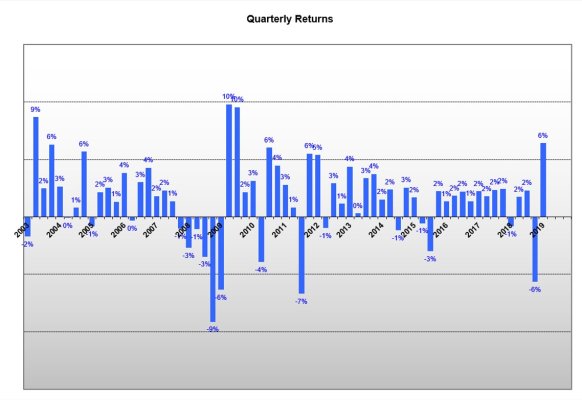

Yes, the market's definitely doing better than expected so far this year - but just for "fun", compare portfolio value on 1/1/18 to now.

I'm up 9.2% YTD (excluding cash returns) on a conservative portfolio, but only up 2.8% total since 1/1/18..my International funds - especially International Value, really killed returns for me last year..(same portfolio was down 5.9% total for all of 2018)..

I'm up 9.2% YTD (excluding cash returns) on a conservative portfolio, but only up 2.8% total since 1/1/18..my International funds - especially International Value, really killed returns for me last year..(same portfolio was down 5.9% total for all of 2018)..