"picking" for us is limited to what we have available to "pick from" and what account. With that said... I buy AAPL from time to time.

35.75% of our portfolio is AAPL. if it goes above 39 I will SELL... for the first time in... a long time. The only other time I sold AAPL was to market time and it worked out alright. Mainly DCA into that one over time, but also have some exposure to via ETFs... This has been a PILLAR of our investing growth over this past decade. Will it continue to be the next, time will tell. I am not a great "picker". The other stocks I picked and just didn't do great with were UNP, XOM, CASY, MMM, TASR, DAL, 3DFX and likely one or two others. I did earn money on MOST of these, with a couple being duds.

I remember losing a lot with 3DFX which was my first time ever buying stock during .com. It was a chip maker. NVDA...man had I known...

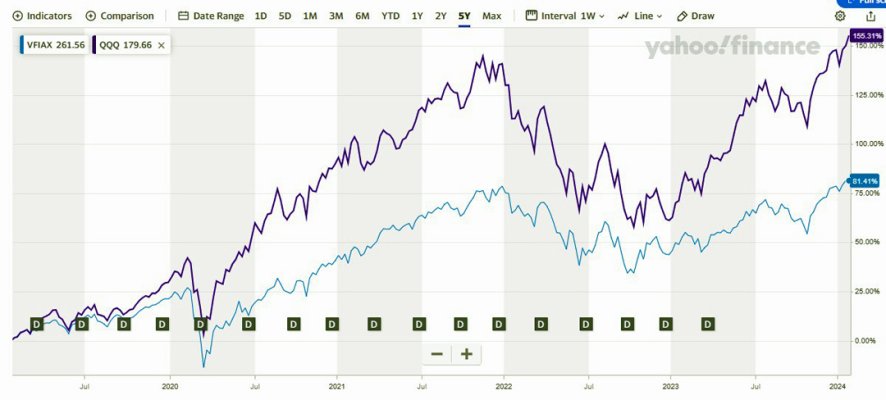

The problem is, I sort of aim for 20 to 40% returns. So I also tend to cut the anchor when the stocks are underperforming...mainly the NASDAQ.

I am tempted to take 3% and put it into NVDA but I might have missed the boat on that one.

Another one I remember was TASR. I thought for sure I had something, but the company ended up getting bought out and I sold after losing about 47% of the stock's value. I think it amounted to about $1500. It was a long time ago but it hurt at the time. Now it would be a blemish.

I can't find a company as consistently stable as AAPL...that I somewhat actually agree in most of the fundamental's, products getting released, innovation, and leadership.

They always seem to know how to churn out a profit over at AAPL.

The LOWEST I bought it at was at $96/share at the advice of Running_Man from this forum here. He probably made me 100s of thousands on that advice alone, so if you are still aroung Running_Man, I know you like to hangout in the charts thread every now and then, thank you sir!

I could see plays in hindsight that made sense. XOM would have been good had my timing and patience been better.

The thing with picking LOTS of stocks to try and beat the market means you need to NOT BE WRONG, a LOT. And it's actually a lot easier to be wrong, than I think it is to find the unicorn and be right. I haven't quite developed a system myself that seems to be of any consistent formula.

I know there are some folks on here who have what appears to be well-thought-out strategy, options plays, sector and market timers etc...and to some extent you can probably do this. I myself look at bank interest rates as one bellweather, the VIX index as another, OIL as a third...I can't list them all dang.

But a lot of folks post their numbers and likely more conservative than I, still have fairly similar performance...often outperforming most of the major 3 indices.

I also see a LOT of people are content with 4 to 6 or 7% returns are GREAT. I want 10, 20, 30, 40!!!

I just don't think I can get there picking a bunch of stuff, plus I have 3 littles and time is my greatest enemy and largest asset that seems to be the most preciously unavailable.

Soooo....

I hold MOSTLY ETFs and a couple Index funds in the 401ks.. With the exception of AAPL. But I might make a play on NVDA this week if it hits a bump somehow. I think AI might be the ticket for the near-term here.