Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

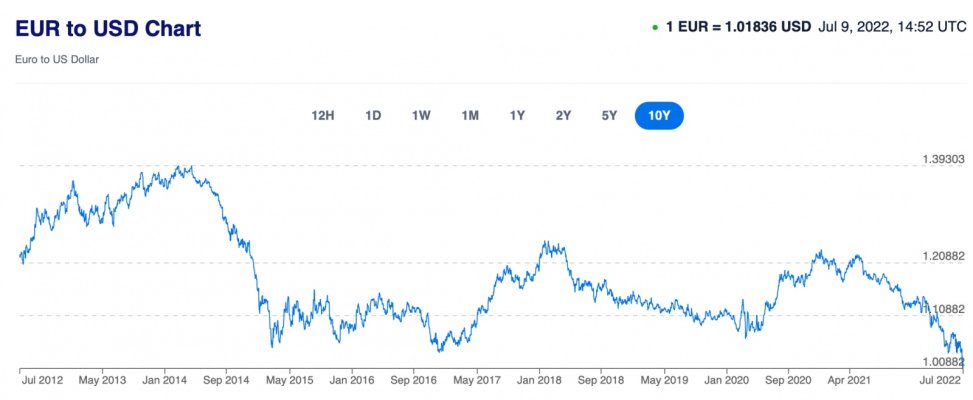

Curious, other than taking a vacation in Europe, has anyone found or considered a way to take advantage of the current 1 Euro = 0.98 USD? Especially in a retirement account? Like is there a low cost fund that lets you buy $200,000 USD in Euros and hold them in a low risk saving account?