Steelart99

Recycles dryer sheets

- Joined

- Apr 24, 2012

- Messages

- 184

This is my first year retired and first year on ACA.

I'm trying to get a handle on my taxes for next year and have to control where I take income since the ACA is based on MAGI. I plan to sell some stock and as I understand it, the long term capital gains is the amount used for MAGI.

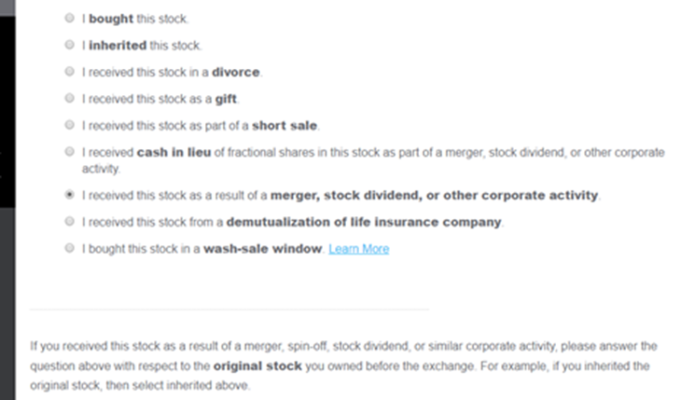

Now, the issue is that the stocks were gifted to me. As I understand it, the LTCG's would be the sale price minus the cost basis of the person who gifted it to me.

But ... I want to sell the reinvested dividends first (using Specific ID's).

The question is, do I have to used the cost basis from the giftor for the reinvested dividends, or do I use the purchase cost at the time that the dividends were reinvested?

I'm trying to get a handle on my taxes for next year and have to control where I take income since the ACA is based on MAGI. I plan to sell some stock and as I understand it, the long term capital gains is the amount used for MAGI.

Now, the issue is that the stocks were gifted to me. As I understand it, the LTCG's would be the sale price minus the cost basis of the person who gifted it to me.

But ... I want to sell the reinvested dividends first (using Specific ID's).

The question is, do I have to used the cost basis from the giftor for the reinvested dividends, or do I use the purchase cost at the time that the dividends were reinvested?

Last edited: