leibowitzn

Confused about dryer sheets

- Joined

- Jun 1, 2022

- Messages

- 5

Hi, I'm working on fine tuning my retirement calculations.

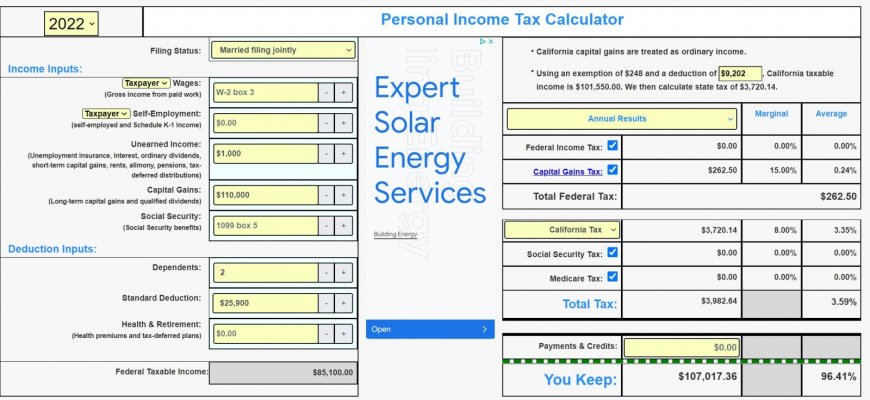

The part I'm stuck on is how much tax I'll be paying when I retire early. I entered my data into taxcaster and dinkytown. Intuit Taxcaster says I'll get a refund while dinkytown says I'll owe $0.

Here's what I entered:

* married filing jointly

* 2 kids

* income comes from 3 sources

*** interest: $1,000

*** qualified dividends: $30,000

*** stock sales: $140,000

For stock sale I have no idea how to estimate the cost basis and capital gains. I made a rough guess of 50% would be capital gains and entered that (so I entered $70,000). (I'd love any advice on how to estimate this better.)

This meant my taxable income was around $100,000.

Does a $0 federal tax rate seem reasonable?

Also, any advice on estimating state taxes?

The part I'm stuck on is how much tax I'll be paying when I retire early. I entered my data into taxcaster and dinkytown. Intuit Taxcaster says I'll get a refund while dinkytown says I'll owe $0.

Here's what I entered:

* married filing jointly

* 2 kids

* income comes from 3 sources

*** interest: $1,000

*** qualified dividends: $30,000

*** stock sales: $140,000

For stock sale I have no idea how to estimate the cost basis and capital gains. I made a rough guess of 50% would be capital gains and entered that (so I entered $70,000). (I'd love any advice on how to estimate this better.)

This meant my taxable income was around $100,000.

Does a $0 federal tax rate seem reasonable?

Also, any advice on estimating state taxes?