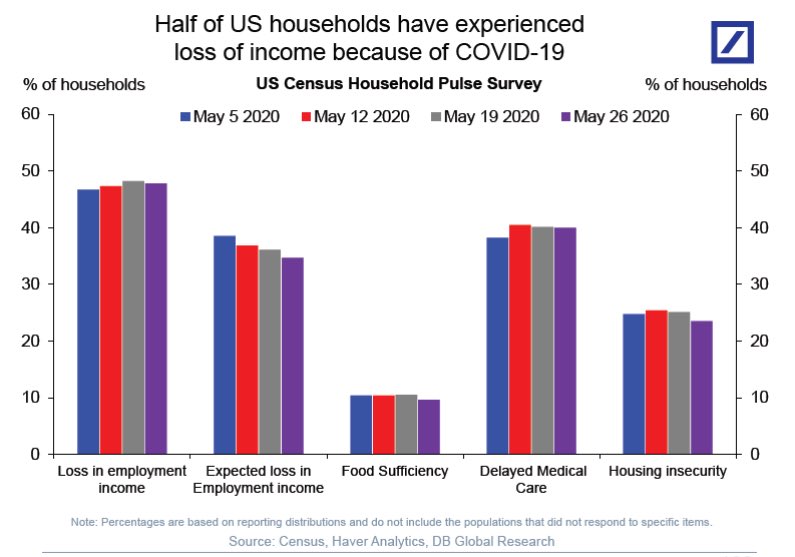

However there's no indication 'most' are going back to work yet. Over 20M still out of work and many working with pay cut. About 50% of households have lower income than Feb, which could trigger a secondary downward spiral not realized yet. And a (safe) vaccine is very unlikely within a couple years however some form of treatment that significantly reduces deaths is more likely.

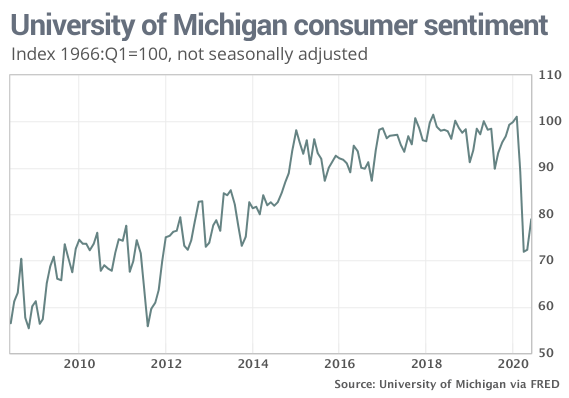

Not saying what will happen but am saying literally no one does know and is being foolish if they claim they do. Pay attention to consumer confidence as one factor (not the factor).

Most are back to work. We are a country of 300+ million. Even the strip mall type businesses are now reopening. Dozens of states have been largely open for a month, now. Shut downs will not be used, again, unless hospitals become overwhelmed and that is not happening. We have learned to live with the virus and the risks.

The stock market is a leading indicator and the employment numbers are a lagging indicator. Consumer confidence is not particularly useful during times of confusion and unrest, so it is a worthless indicator, right now.

Anecdotally, where I live (Washington state), traffic is back to normal and shopping trips are met with the pre-corona crowds. We are technically still in shut-down mode, but businesses are restarting, anyway.

There are several big cities that are still hurting due to the lack of tourism, restaurants and poor leadership, but the American economy is much wider and deeper than those enclaves.

Just a prediction, not a claim to certainty, but the market should trade side-ways with smaller moves up and down until the vaccine is announced towards the end of the year.