shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 538

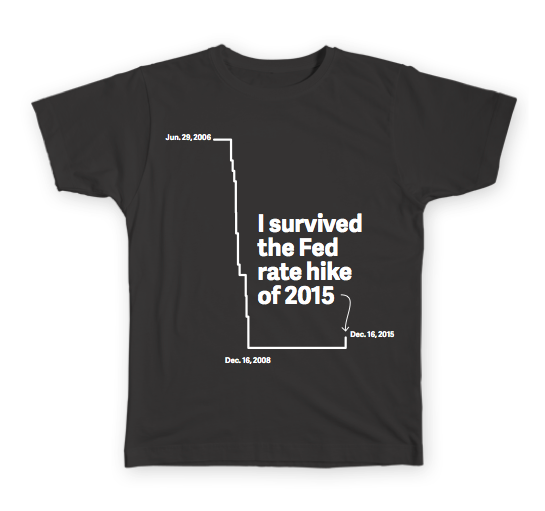

They should have started with a full 100 basis points. This is wimpy start to a long overdue rate tightening. It will be nice when we get over 5 percent again.

Sent from my iPad using Early Retirement Forum

I very much doubt we will see anything even close to 5% again given the huge run up in the national debt. 5% on $20 trillion is a trillion dollars which is more than a quarter of the national budget for 2016. Given the escalating costs of entitlements, keeping interest rates low is a better political option. Yes I know the FED is supposed to be independent but I don't really believe it is deaf to the consequences of higher interest rates on the federal budget. I believe low rates are hear to stay for a very long time. (I am not attempting to turn this into a political discussion, just trying to point out what I think is a major factor in the decision process for rate hikes).