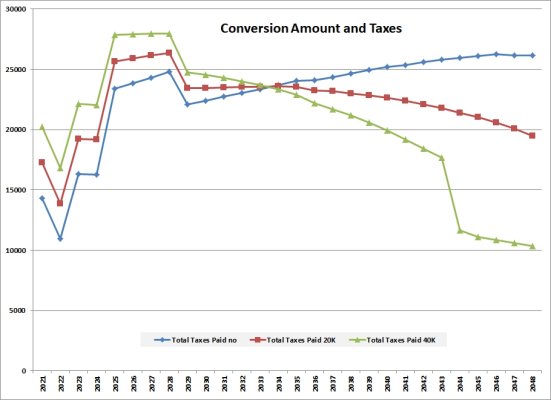

I have been using the NewRetirement PlannerPlus tool with the Roth Explorer feature. The Roth feature provides recommendations on when to execute Roth conversions for my DW and I 401k funds. Based on the conversions, it looks like I would eliminate any RMDs starting at age 72.

However, the Roth conversions have a huge tax bill for each year of the conversion.

Any feedback from other doing 401K Roth conversions and how to justify the benefits of the conversions.

Be patient with me as I'm a newbie on this topic.

P.S. I would need to tap into my 401K funds at age 57 (Rule of 55) and my wife will need to tap into her funds at age 61. I am 56 and my wife is 59.

Here is a YouTube video I'm using as a point of reference.

However, the Roth conversions have a huge tax bill for each year of the conversion.

Any feedback from other doing 401K Roth conversions and how to justify the benefits of the conversions.

Be patient with me as I'm a newbie on this topic.

P.S. I would need to tap into my 401K funds at age 57 (Rule of 55) and my wife will need to tap into her funds at age 61. I am 56 and my wife is 59.

Here is a YouTube video I'm using as a point of reference.

Last edited: