JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,730

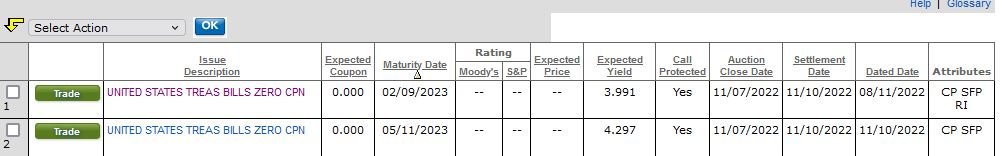

Looks like the 13 and 26 are coming out today. I'm waiting for them to be available to buy. Last I checked, I was not able to order them.

Usually early afternoon.

, so I prefer short term in that account.

, so I prefer short term in that account.