W2R

Moderator Emeritus

I like the CD version instead of the download version (probably because I'm older than Methuselah and want to have something tangible in my possession).

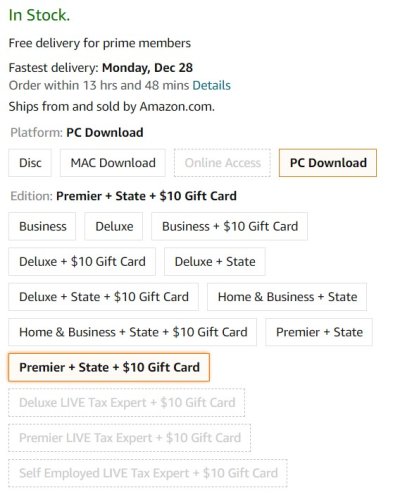

Right now Amazon is having their usual sale on TurboTax, that they always have right after Christmas, so I ordered mine:

TurboTax Deluxe with state, CD version, $39.99.

Right now Amazon is having their usual sale on TurboTax, that they always have right after Christmas, so I ordered mine:

TurboTax Deluxe with state, CD version, $39.99.