You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Turbo Tax/IRS Acceptance

- Thread starter eytonxav

- Start date

eytonxav

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Out of curiosity, did you have to file a 8960 (net investment income tax)? It seems like that is causing significant problems with filings? Mine got rejected.

No

Mine was accepted almost immediately also. But IIRC, accepting just means the forms were filled out ok... it has not been processed/verified yet. That usually takes another 1-2 weeks, then they process the refund... which takes another couple weeks.

Out of curiosity, did you have to file a 8960 (net investment income tax)? It seems like that is causing significant problems with filings. Mine got rejected.

This is a known IRS e-file server problem. The IRS says the fix will happen sometime late-Feb to mid-March.

W2R

Moderator Emeritus

Filed my taxes today and the return was accepted by the IRS almost immediately. Hope the refund comes quickly.

Oh this is GREAT to hear!

I just filed mine electronically with Turbo-Tax about 10 minutes ago. Edited to add: after reading your post, I just checked (a few minutes later) and it has already been accepted too.

I just filed mine electronically with Turbo-Tax about 10 minutes ago. Edited to add: after reading your post, I just checked (a few minutes later) and it has already been accepted too. I owe the feds $585, but then found out that Louisiana is giving me a $722 refund! Whew, so overall I guess I "made out" to some extent. That's good because I have had a series of big expenses lately and would rather not have another one.

The IRS will take the $585 directly from my checking account, and Louisiana will deposit the $722 into that same checking account when they get around to it. Since it's Louisiana sending the refund, I might not get it for several months. At least, in the past they have been a bit slow. Still, it helps to know it's on the way.

(Oh, and Toocold, I didn't have to file an 8960 AFAIK.)

Morgan22

Recycles dryer sheets

I filed on the 4th. Refunds showed pending for deposit on the 9th for CA and 10th for Fed. So only a week turn around.

gayl

Thinks s/he gets paid by the post

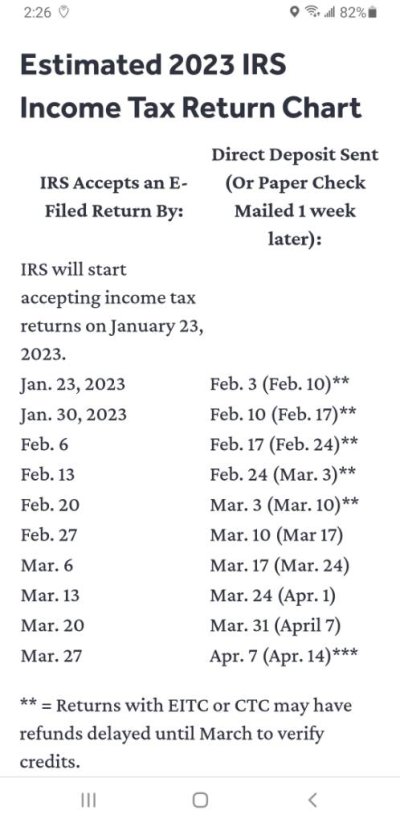

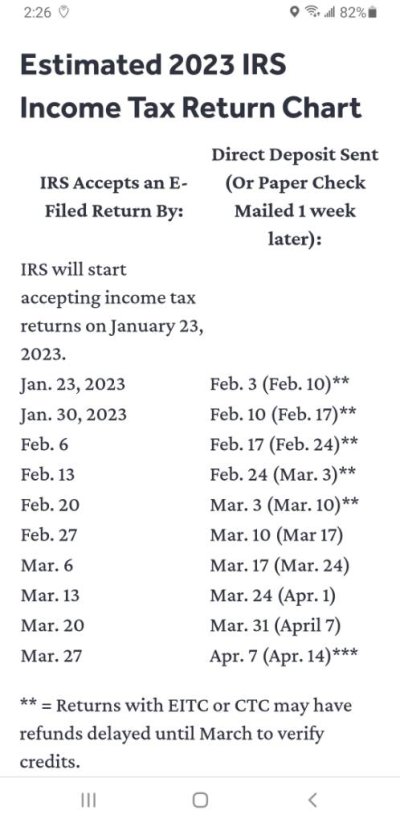

I found this online. Hope it's right (filed / accepted yesterday)

https://www.cpapracticeadvisor.com/2023/01/30/chart-shows-estimated-2023-irs-tax-refund-dates/75194/

https://www.cpapracticeadvisor.com/2023/01/30/chart-shows-estimated-2023-irs-tax-refund-dates/75194/

I submitted mine at 3:40 PM on February 1st. It was accepted at 4:15, and the refund had already been credited to my bank account when I checked on February 7th. So, less than a week, something like 3-4 business days. First time that has ever happened.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Everyone gets so excited about refunds. All it means is you paid too much tax in the first place. We have not had a refund for 25 years. I would rather pay at the end of the year rather than up front. Never had a penalty either as our underpayment was always relatively small. We owe $1,650 this year, mostly ACA underpayment, I will not file till April.

I don't set out trying to get a refund, but when I'm itemizing deductions - especially medical deductions - not getting a refund just means I got lucky & didn't have any unanticipated expenses that year. I wasn't that lucky last year, so I got a refund this month. Maybe I'll have better luck this year, maybe not.Everyone gets so excited about refunds. All it means is you paid too much tax in the first place.

And yes, I suppose I could have the tax withholding on my pension reduced to compensate when I have an extra deductible expense, but I could wind up having to do that multiple times in a year & then I'd have to remember to reset it at the end of the year, and I just can't be bothered unless the refund gets up into the thousands of dollars, and so far it hasn't done that. I don't get excited over a few hundred dollar refund but I don't feel bad about it either.

Last edited:

I know I'd be better off putting that money into savings, but my refund isn't much and interest rates aren't that great anyway. Plus, it's handy to even out my cash flow, since a lot of expenses come due early in the year. The convenience is probably worth the small opportunity cost. That, and it always feels better to get money than pay.

Cassius King

Recycles dryer sheets

Not necessarily. Huge rebate for going solar last year.Everyone gets so excited about refunds. All it means is you paid too much tax in the first place. We have not had a refund for 25 years. I would rather pay at the end of the year rather than up front. Never had a penalty either as our underpayment was always relatively small. We owe $1,650 this year, mostly ACA underpayment, I will not file till April.

This is a known IRS e-file server problem. The IRS says the fix will happen sometime late-Feb to mid-March.

Hopefully they get it fixed. I still have to do estimated taxes for 2023 and I don't want to confuse them by sending even more money to them

Morgan22

Recycles dryer sheets

Everyone gets so excited about refunds. All it means is you paid too much tax in the first place.

We would prefer not to get a refund. But we are forced to have 20% withholding for retirement fund distributions. We did ask if they could only w/h 5%, but they said they were required by law to w/h 20%. So I filed as soon as I had all 1099's.

Mine was accepted almost immediately also. But IIRC, accepting just means the forms were filled out ok... it has not been processed/verified yet. That usually takes another 1-2 weeks, then they process the refund... which takes another couple weeks.

Right. My business taxes were accepted, but then I got a letter from the IRS Processing Operations center in Ogden asking me to clarify some information related to my S-corp. I need to call them tomorrow and make sure the fax was received and check if they need anything else.

Fed and state personal taxes were accepted today after a looong delay of waiting for my K-1 worksheet to be finalized and approved for filing.

TurboTax says it could take "longer than 3 weeks" if I paper file, vs e-file. So my guess is assuming everything processes and all the infromation isn't challenged by the IRS, a refund for me will be here within 21 days.

W2R

Moderator Emeritus

Louisiana has accepted my tax return, too. So now the waiting begins.

I had a mind-boggling fantasy just now. It will never happen, no way, no how! But here it is. What if there were some sort of law, that after personally preparing one's own tax forms oneself for fifty years straight, with no help except software, and paying taxes each of those years, one could get some sort of lifetime tax amnesty? Fifty years of this and no more EVER for the rest of one's life.

Well, I told you it would never happen. But wow, such a nice fantasy. Many of us have done this each year for over 50 years (56, myself), and could sure use an "attaboy" from the feds for our half century of effort.

But wow, such a nice fantasy. Many of us have done this each year for over 50 years (56, myself), and could sure use an "attaboy" from the feds for our half century of effort.

I had a mind-boggling fantasy just now. It will never happen, no way, no how! But here it is. What if there were some sort of law, that after personally preparing one's own tax forms oneself for fifty years straight, with no help except software, and paying taxes each of those years, one could get some sort of lifetime tax amnesty? Fifty years of this and no more EVER for the rest of one's life.

Well, I told you it would never happen.

eytonxav

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Louisiana has accepted my tax return, too. So now the waiting begins.

I had a mind-boggling fantasy just now. It will never happen, no way, no how! But here it is. What if there were some sort of law, that after personally preparing one's own tax forms oneself for fifty years straight, with no help except software, and paying taxes each of those years, one could get some sort of lifetime tax amnesty? Fifty years of this and no more EVER for the rest of one's life.

Well, I told you it would never happen.But wow, such a nice fantasy. Many of us have done this each year for over 50 years (56, myself), and could sure use an "attaboy" from the feds for our half century of effort.

What an excellent fantasy, we need to start a petition to the law makers.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,990

As usual yesterday I paid my taxes via the IRS website and mailed my paper forms. No need for my free TurboTax from Fido. It ain't that hard. Always owe them is the key.

rrs26ja

Dryer sheet aficionado

I filed our taxes. They were accepted both fed and NYS, but then I received another 1099-R for a distribution that I had forgotten that I took. I went in to amend my return, but it says it won't be ready until the end of Feb. Initially it said 02/16 which was yesterday.

Osprey

Recycles dryer sheets

- Joined

- Jul 28, 2016

- Messages

- 144

Out of curiosity, did you have to file a 8960 (net investment income tax)? It seems like that is causing significant problems with filings. Mine got rejected.

[Updated on TurboTax Feb 17, 2023]

According to Turbo Tax: This issue will be resolved on February 19, 2023. On or after this resolution date you may resubmit this return for electronic filing.

I had a mind-boggling fantasy just now. It will never happen, no way, no how! But here it is. What if there were some sort of law, that after personally preparing one's own tax forms oneself for fifty years straight, with no help except software, and paying taxes each of those years, one could get some sort of lifetime tax amnesty?

While we're fantasizing, here's one: The government already gets all the same forms I do. They already do all the calculations and will call me out on it if I make a mistake.

How about they just complete the form and send me a check or a bill?

It's totally possible, but it will never happen as long as there are tax-prep lobbyists throwing cash at all our elected officials.

W2R

Moderator Emeritus

While we're fantasizing, here's one: The government already gets all the same forms I do. They already do all the calculations and will call me out on it if I make a mistake.

How about they just complete the form and send me a check or a bill?

It's totally possible, but it will never happen as long as there are tax-prep lobbyists throwing cash at all our elected officials.

Besides, it's too sensible!

And here I thought they just wanted everyone to go through the tax preparation process, to brush up on arithmetic skills...