My wife and I were in a similar situation with the opportunity to buy into her pension plan at an international organization (like the World Bank) for the 3 years that she was on leave without pay before resigning. Each year would cost us about 8% of her annual salary to increase her pension by 3% of her high two years working with the pension fully COLed (including while it was pending!). Virtually a no brainer! But I would still be careful about committing too high a proportion of my resources to something like this.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Unlimited Pension Buy In

- Thread starter RetireAge50

- Start date

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If you were age 65, had a $1,500,000 portfolio and $60,000 estimated expenses how much would you convert to this pension?

1. NO LIMIT on buy in amount (send a check or convert from other retirement accounts).

I have never heard of such a deal.

May I ask who offers it?

My pension did have an offer to buy up to 5 more years of service credit. That was it. No more. And the return, at least initially, was OK, but nothing that could not be matched in a good bond fund. What I liked about it was the capped COLA, and it allowed me to get my pension leg up to where I thought it should be.

FWIW, the more I see of the nonsense going on with employee pension, the more I think people should control their own money. Had Detroit happened before I bought into my pensions extra service credit plan, I am not certain if I would have bought into it, or, perhaps, might have bought less years.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have noted that many people are critical of the capped COLA. Certainly, an uncapped COLA is better, but how many people have that offered to them? And how secure will it be over a 20-30 year period?

3% is a limited cap, but keep in mind that if a 60 year old lives to his expected 85 years, the monthly payments in that last year will have more than doubled. Not fantastic, but the guy with the non COLA'd pension will probably think it's pretty good.

And, if one is a woman, with their 5+ years of extra lifespan, the benefits of the capped COLA will be even greater. A final payment almost 2.5x greater than the initial payment.

3% is a limited cap, but keep in mind that if a 60 year old lives to his expected 85 years, the monthly payments in that last year will have more than doubled. Not fantastic, but the guy with the non COLA'd pension will probably think it's pretty good.

And, if one is a woman, with their 5+ years of extra lifespan, the benefits of the capped COLA will be even greater. A final payment almost 2.5x greater than the initial payment.

?? The longer the expected payout, the bigger the potential discrepancy between a capped COLA pension and the actual cost of things.And, if one is a woman, with their 5+ years of extra lifespan, the benefits of the capped COLA will be even greater. A final payment almost 2.5x greater than the initial payment.

A capped 3% COLA is better than no COLA, but it should be recognized as posing a big risk of not keeping up with inflation.

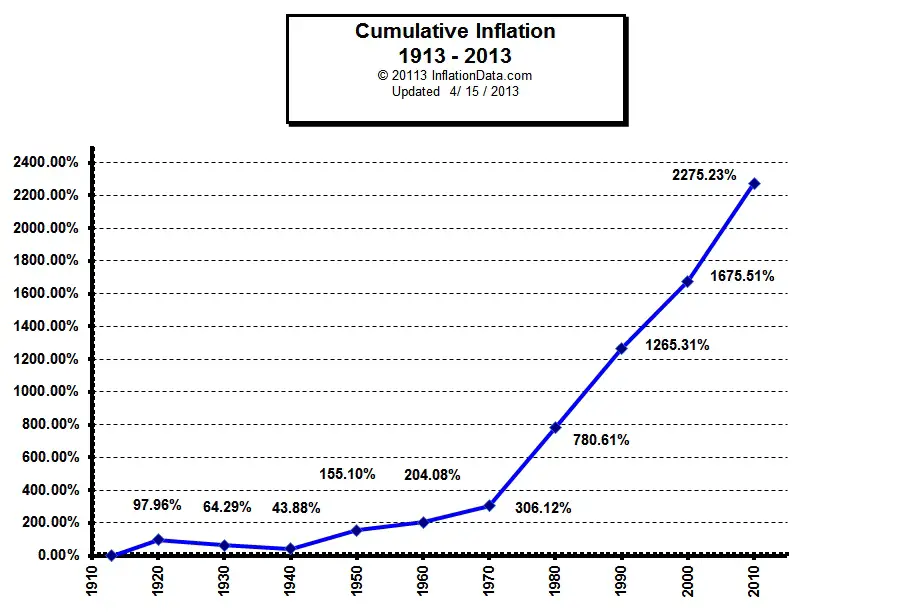

A graph of prices (as opposed to annual inflation%) shows this best. For person who retired in 1980 to 2000 (a period of historically moderate inflation), prices went up by a factor of 2.15. A pension going up at 3% every year would have gone up by 1.81, so the monthly pension lost about 15% of its value. Between 1970 and 1990 (just 20 years), prices went up by a factor of 4.13, and a pension growing at 3% per year (a factor of 1.81 over this time) would have lost over 55% of its real value. Let's hope we don't have another stretch like that, but there are indications it may be in the cards.

Last edited:

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

?? The longer the expected payout, the bigger the potential discrepancy between a capped COLA pension and the actual cost of things.

A capped 3% COLA is better than no COLA, but it should be recognized as posing a big risk of not keeping up with inflation.

A graph of prices (as opposed to annual inflation%) shows this best. For person who retired in 1980 to 2000 (a period of historically moderate inflation), prices went up by a factor of 2.15. A pension going up at 3% every year would have gone up by 1.81, so the monthly pension lost about 15% of its value. Between 1970 and 1990 (just 20 years), prices went up by a factor of 4.13, and a pension growing at 3% per year (a factor of 1.81 over this time) would have lost over 55% of its real value. Let's hope we don't have another stretch like that, but there are indications it may be in the cards.

The capped COLA is better than a no COLA pension. We agree on that, right?

In the case of the longer lived woman, would not the discrepancy be even greater if she had a non COLA'd pension? Or am I missing something?

I am not arguing for a person to live in blissful ignorance of inflation just because they have a capped COLA.

Pensions, for those who have them, are just one part of an investment strategy. Many of us take advantage of a pension's income certainty to invest our other assets in ways we think will give us a fighting chance against inflation in the long run, albeit with many short term ups and downs. All things being equal, a capped COLA pension gives us a bit more ammunition than a non COLA'd pension. Nothing wrong with that unless we are lulled into complacency.

You are right to warn us of the dangers of being complacent while inflation chews away at our buying power. I think we basically agree, but these forums make is hard at times to fully understand what others are saying. My bad if I was unclear.

Last edited:

A question for the readers here: does the US Government or Federal reserve have an inflation target?

The EU has: "close to but under 2%"

Just a factor to consider. I kindof trust the EU for example to be able to achieve its goal in the longer term. We don't understand inflation fully but alot better than the 80s.

The EU has: "close to but under 2%"

Just a factor to consider. I kindof trust the EU for example to be able to achieve its goal in the longer term. We don't understand inflation fully but alot better than the 80s.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Why is 2 percent the Federal Reserve’s inflation target? Because it is. - The Washington PostThe Federal Open Market Committee (FOMC) judges that inflation at the rate of 2 percent (as measured by the annual change in the price index for personal consumption expenditures, or PCE) is most consistent over the longer run with the Federal Reserve’s mandate for price stability and maximum employment.

Yes--a capped COLA pension is better than one that stays at the same dollar figure.The capped COLA is better than a no COLA pension. We agree on that, right?

Yes, the difference between "uncapped COLA" and "capped COLA" isIn the case of the longer lived woman, would not the discrepancy be even greater if she had a non COLA'd pension?

larger and more important for the woman, who is likely to live a longer time.

The difference between "no COLA" and "capped COLA" is also more important to the woman than to the man. She can expect to "lose ground" against inflation for a longer time, so the ultimate impact of these compounded losses will be greater.

I think we understand each other now. In your earlier post, the term "benefits of a capped COLA" threw me. The COLA is a benefit, the "capped" part is obviously not. The woman benefits from the COLA, but the cap hurts her more than it would hurt a male.

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Post deleted

Last edited:

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

Reran our expected income using the additional pension option and as it turns out it doesn’t make much difference. This is due to having multiple sources of income, namely pension, social security, and portfolio.

Some things to ponder with 3 evenly weighted legs:

A market meltdown hits the portfolio temporarily and even a 50% hit reduces income by only 17%

Inflation hits the pension permanently.

Government may make changes to pension, social security, and taxes. Starting to understand how a mix of income sources is important. Maybe something will survive.

I am only 47 and trying to plan for something that might happen at age 65 is probably pointless. I hope I still have the mental capacity later. Want to get some of this written down just in case.

Some things to ponder with 3 evenly weighted legs:

A market meltdown hits the portfolio temporarily and even a 50% hit reduces income by only 17%

Inflation hits the pension permanently.

Government may make changes to pension, social security, and taxes. Starting to understand how a mix of income sources is important. Maybe something will survive.

I am only 47 and trying to plan for something that might happen at age 65 is probably pointless. I hope I still have the mental capacity later. Want to get some of this written down just in case.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A market meltdown hits the portfolio temporarily and even a 50% hit reduces income by only 17%

Inflation hits the pension permanently.

Good points on what is permanent and what is temporary.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

Looking at annuity for 65 year old couple. I am seeing a best quote of 5.5% for joint survivor with no COLA. So if it was my choice I'd invest 1/4 to 1/2 of my assets depending, on factors like heirs and how much money I really planned on spending.

A really don't understand what a government know that private insurers don't know that allow them to offer such a superior investment.

A really don't understand what a government know that private insurers don't know that allow them to offer such a superior investment.

That's a good point. I suspect the answer is that they don't but it is to their advantage to offer this "superior investment." If it sounds too good to be true....A really don't understand what a government know that private insurers don't know that allow them to offer such a superior investment.

The only people I distrust more than insurance companies are government bureaucracies.

Similar threads

- Replies

- 87

- Views

- 9K

- Replies

- 34

- Views

- 3K

- Replies

- 15

- Views

- 8K

- Replies

- 38

- Views

- 2K