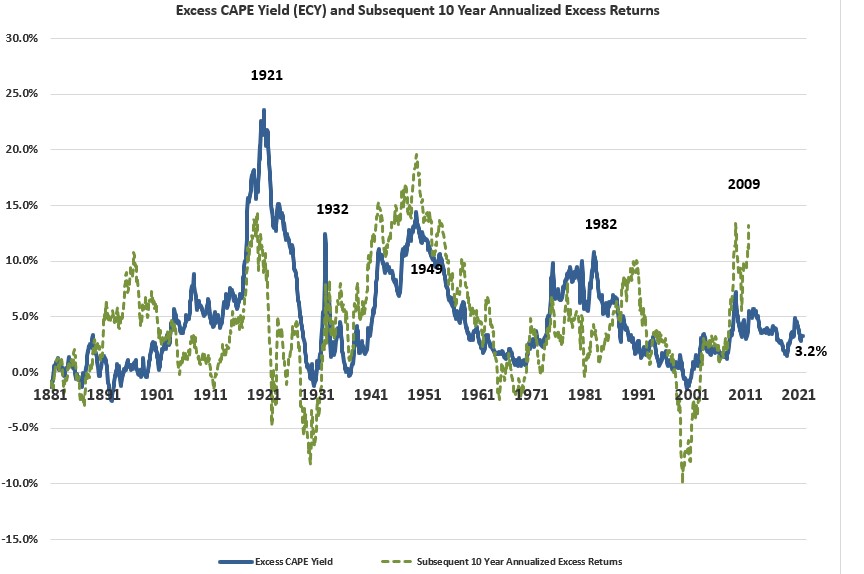

Numerous times over the past 30+ years of investing and ESPECIALLY in the last ten I see concern over "valuations" and how they spell trouble for stocks. Following that narrative can be very damaging to returns as explained in this article:

https://www.fisherinvestments.com/e...ont-think-high-valuations-signal-a-dim-future

https://www.fisherinvestments.com/e...ont-think-high-valuations-signal-a-dim-future