harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

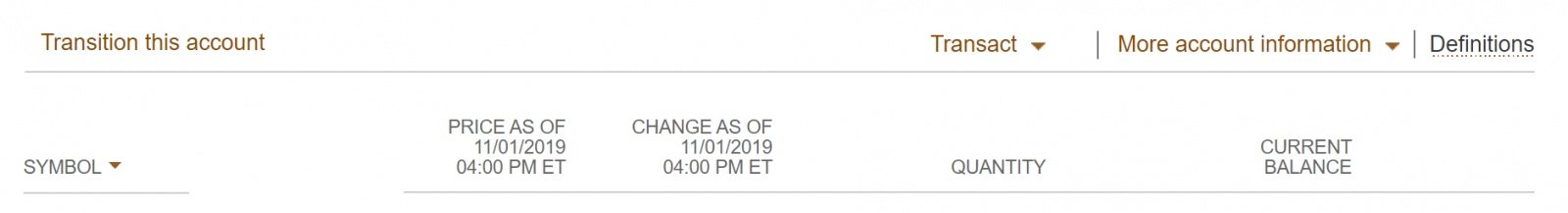

I have a fairly large Vanguard IRA on the old platform (just mutual funds). I recently got a notice from Vanguard that I need to transition to the new brokerage platform because the old platform is going away. I log on and went to my account, searched everywhere and could not find a way to transition. I contacted my account rep (yes I still have one of those) who is going too send me the paperwork to do the transition but he says one of the forms will have to be notarized (the form pointing my DH as my agent). I told him that the notary is too much trouble, I had already appointed my husband as my agent and that should just transition over without having to be redone. What is this transition thing so much trouble? What if I don't do the transition? Will Vanguard close my account?