Hi, We have been thinking and planning about retirement for a while. We are in our early 60s.

Financially, we are in decent shape. We both have small pensions and qualify for SS. Last analysis says we have a near perfect chance to spend about $10K a month after tax if I walked out today.

Our concerns are mostly in two areas. The #1 is the cost of health care. If we do Roth conversion before we start taking SS, the taxable income is likely pushing us out of ACA.

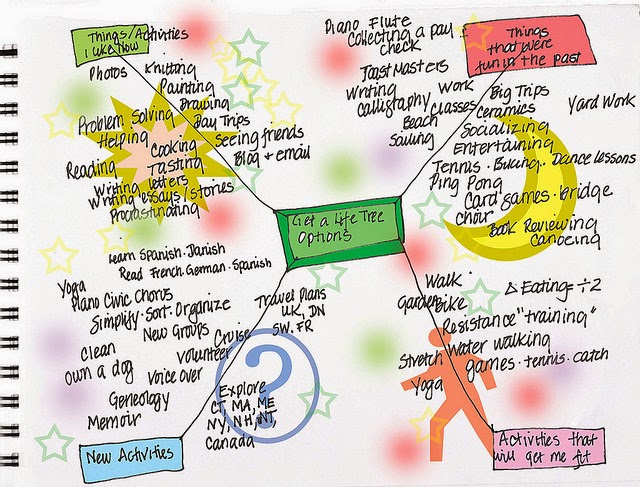

The #2 is what to retire to? Travel the world is our desire. But it is not practical to be on the road more than a couple months a year. What do you do with all these free time? I have heard several cases that people went back to work due to "I am bored".

Glad to find this community. I don't think our situation is that unique. Looking forward to hearing about your experiences. Any tips and comments will be greatly appreciated.

Financially, we are in decent shape. We both have small pensions and qualify for SS. Last analysis says we have a near perfect chance to spend about $10K a month after tax if I walked out today.

Our concerns are mostly in two areas. The #1 is the cost of health care. If we do Roth conversion before we start taking SS, the taxable income is likely pushing us out of ACA.

The #2 is what to retire to? Travel the world is our desire. But it is not practical to be on the road more than a couple months a year. What do you do with all these free time? I have heard several cases that people went back to work due to "I am bored".

Glad to find this community. I don't think our situation is that unique. Looking forward to hearing about your experiences. Any tips and comments will be greatly appreciated.

Last edited: