Freedom56

Thinks s/he gets paid by the post

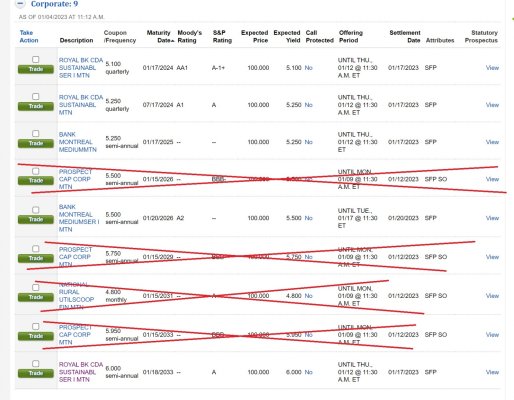

Fidelity now has some note offerings from Canadian Banks.

78014RKA7 - 1 year (6 month call protection) 5.1% From Royal Bank of Canada rated AA1/A1+

78014RKB5 - 18 Month 5.25% note from Royal Bank of Canada with one year call protection

06374VCK0 - 3 year 5.25% note from Bank of Montreal with 18 months call protection

06374VCH7 - 4 year 5.5% note from Bank of Montreal with 18 months call protection

78014RKE9 - 10 year 6% note from Royal Bank of Canada with 2 years of call protection

78014RKA7 - 1 year (6 month call protection) 5.1% From Royal Bank of Canada rated AA1/A1+

78014RKB5 - 18 Month 5.25% note from Royal Bank of Canada with one year call protection

06374VCK0 - 3 year 5.25% note from Bank of Montreal with 18 months call protection

06374VCH7 - 4 year 5.5% note from Bank of Montreal with 18 months call protection

78014RKE9 - 10 year 6% note from Royal Bank of Canada with 2 years of call protection