newtoseattle

Recycles dryer sheets

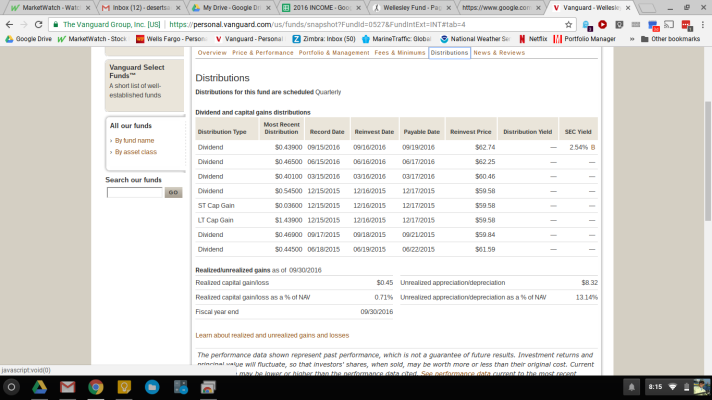

? capital gains distributions

A bit off topic, but I think I see the hypothetical 200K in Wellesley and Wellington would have distributed about 12000$ in capital gains and actually ended the year down a couple thousand.

Is there any predictability to capital gains distributions? i.e. what has been the range over the last 10 years?

If you "spend" all the capital gains distributions and dividends has the "principal" kept up with inflation?

I know the past does not predict the future, but trying to figure out how one would "manage" this "set it and forget it" portfolio during distribution times (i.e. they need the income/distributions)

A bit off topic, but I think I see the hypothetical 200K in Wellesley and Wellington would have distributed about 12000$ in capital gains and actually ended the year down a couple thousand.

Is there any predictability to capital gains distributions? i.e. what has been the range over the last 10 years?

If you "spend" all the capital gains distributions and dividends has the "principal" kept up with inflation?

I know the past does not predict the future, but trying to figure out how one would "manage" this "set it and forget it" portfolio during distribution times (i.e. they need the income/distributions)