My current situation is "retired, no pension or SS". The Outside World doesn't really affect my plan.

Gross Allocation:

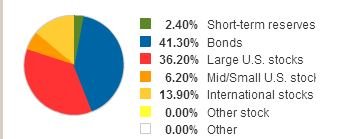

55% equities

45% fixed income

Equities are split 70% domestic, 30% international. Domestic equities are split 80% total stock market, 20% small cap value, in case that Fama-French 3 factor boost is real.

Fixed income is split between a year's worth of cash and a half and half combination of Treasury Inflation Protected Securities and an intermediate term bond fund. (The bond fund is the lease efficient taxwise, and is mostly in an IRA. The TIPS are exempt from state tax, so they're OK in the regular taxable account, as my effective Federal tax rate is about zero.)

The Fiddly Details, ignoring cash and rounding to two places because more precision is just silly:

23% Intermediate Term Bond Fund

23% TIPS fund

31% Total Stock Market Fund

8% Small Cap Value

17% FTSE All World Ex-US

I rebalance once a year if any of these get below 75% of the target percentage, or above 125%. That is, most years I don't rebalance, and I don't need to obsess over the current allocation on a daily basis. I'm lazy... Cash is raised if needed as part of the annual check, selling off whatever is closest to the top of the band to bring it closer to my target. The portfolio is managed for total return, not dividends. My policy document says to tax loss harvest when the opportunity presents itself, so I did that as part of the 2009 rebalance. I won't have to worry about paying taxes on capital gains in my lifetime...