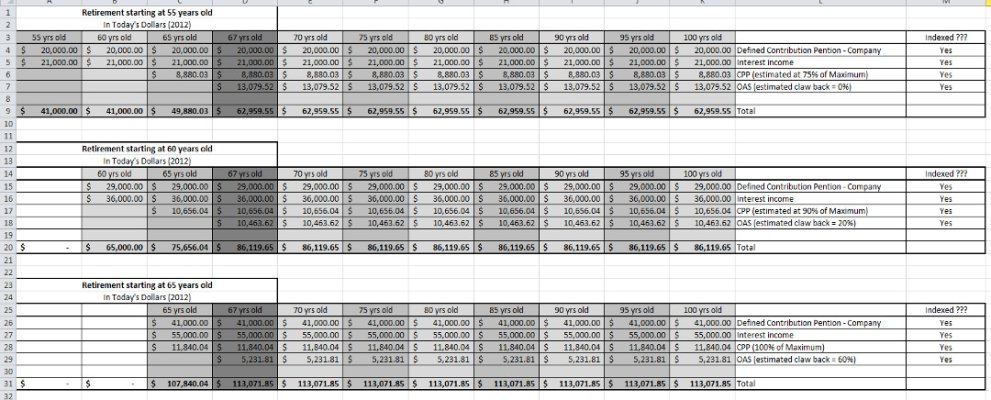

I've attached a pic of my retirement income spreadsheet. I'm curious as to when you would decide to retire based on my situation. I'm leaning somewhere between 58 and 60 years old (I'm currently 46). I have to admit I would love to retire earlier, but I'm not sure if I want to live on the edge with only $41,000 income for the first few years.

My 2012 expenses (which I assume will basically be what my expenses will be in retirement for the first decade) are $41,000 (not including income tax).

All future incomes is shown in today's dollars. My wife and I live in Canada, so the OAS and CPP are approximates ... but close to what the actuals would be. I should also add that I'm a bit conservative, which is why I have it running out to 100.

I would appreciate any feedback, or suggestions.

My 2012 expenses (which I assume will basically be what my expenses will be in retirement for the first decade) are $41,000 (not including income tax).

All future incomes is shown in today's dollars. My wife and I live in Canada, so the OAS and CPP are approximates ... but close to what the actuals would be. I should also add that I'm a bit conservative, which is why I have it running out to 100.

I would appreciate any feedback, or suggestions.