One must realize that international vs domestic is hard to distinguish.

With the recent number of historically USA based companies going for a tax inversion and merging with international entities, it's very hard to say what is domestic and what is international these days. Add to that the global exposure that many multinationals have in terms of revenue, R&D and manufacturing that is global and the whole idea of non-correlated markets goes out the window.

I hold about 20 percent VXUS... But many argue that just holding the SP500 exposes one to more than 20 percent "international" exposure in one form or another. At the large cap level, Markets are very tied together and correlates. Mid and small cap is less so but not by a whole lot...

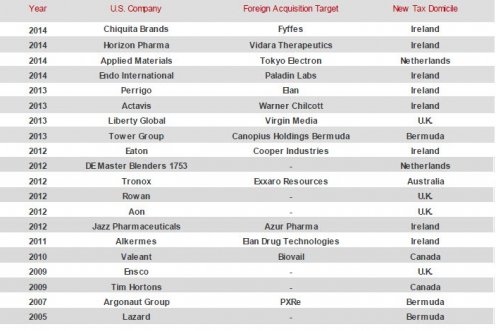

Some examples below. ... Excluding Pfizer which was a big inversion.

How's your Gaeilge coming along??

View attachment 23229