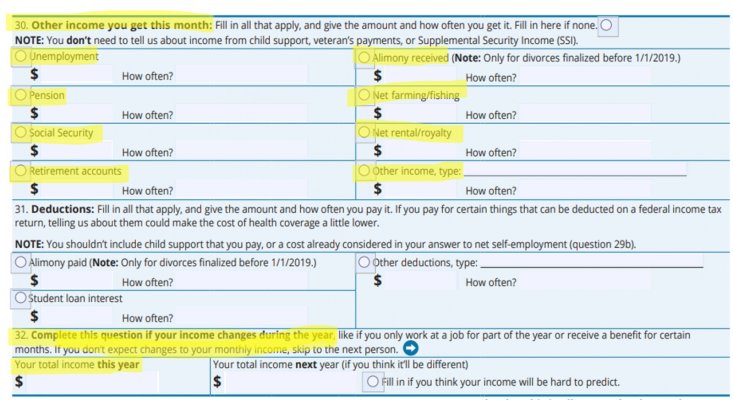

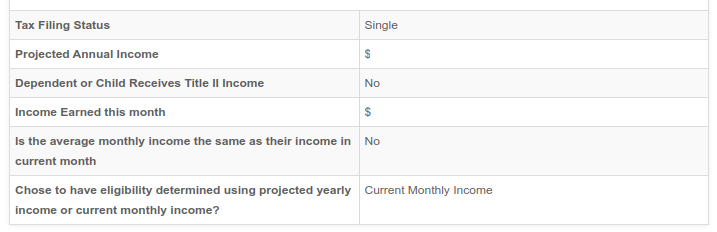

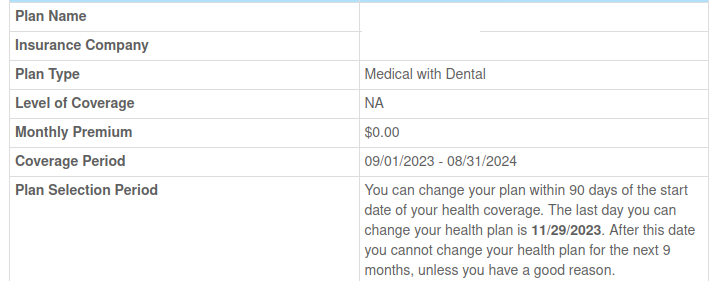

If you have high income in the front of the year and some low months after you retire there is a trick that works. Since I was locked into Medicaid due to the pandemic the last three years, I recently got recertified, but annual income is too high. Turns out one low month in the recert month locks you in for a year, at least in NY. I reported the too high annual income, and the low month income at the same time, and it put me in. Some months are very low while others are way high. Reporting high income after you are on it doesn't make you lose it, because they only care about the recert month.

This is also good to know if you want to avoid Medicaid, since you may be put in it if you report income in a certain way, so never report a low month and you avoid it.