They want you to estimate 2024 income now. It gets reconciled to actual spring 2025. You can update the estimate through the year as needed.If you’re filling this in during annual enrollment for coverage to start Jan 1, are you supposed to fill in current year income amounts or estimate of next year income? Specifically, if 2023 is final year employed, income is very high but will drop drastically in 2024 when retired. If I use the lower numbers will it cause a problem when they get my 2023 tax return and see much higher numbers, or they will only care about 2024 income when they get that tax return in spring of 2025?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When to do ACA sign up?

- Thread starter disneysteve

- Start date

You must have not clicked on the link. There is no option to "choose monthly". And it ONLY asks monthly, not annual option. And it doesn't say "current". It looks like it's asking for the average monthly.They want to know current month income OR estimated yearly income. If you choose monthly you put in the actual income for the month and if under $1,677 it goes to Medicaid. That is how it works in NYSOH.

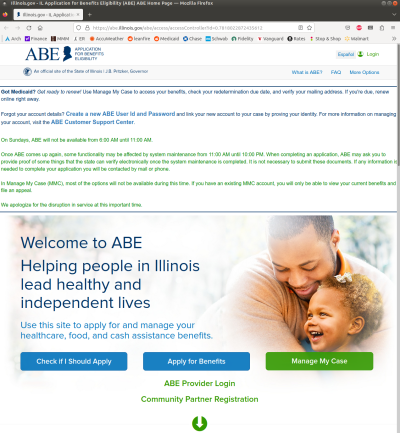

I tried the link, this is what I see (see attachment). Anyway, the law is current monthly and that is what counts. https://www.law.cornell.edu/cfr/text/42/435.603You must have not clicked on the link. There is no option to "choose monthly". And it ONLY asks monthly, not annual option. And it doesn't say "current". It looks like it's asking for the average monthly.

Attachments

Yeah, but you have to click the button "check if I should apply".I tried the link, this is what I see (see attachment). Anyway, the law is current monthly and that is what counts. https://www.law.cornell.edu/cfr/text/42/435.603

I noticed in the page you linked to, it doesn't say "current month", it says "current monthly income." These aren't necessarily the same, which is clarified by this info on that same webpage:

In determining current monthly or projected annual household income and family size under paragraphs (h)(1) or (h)(2) of this section, the agency may adopt a reasonable method to include a prorated portion of reasonably predictable future income, to account for a reasonably predictable increase or decrease in future income, or both, as evidenced by a signed contract for employment, a clear history of predictable fluctuations in income, or other clear indicia of such future changes in income.

Last edited:

As long as income is reasonably predictable, so a Roth conversion done at different times and for different amounts wouldn't be reasonably predictable and couldn't be prorated into your number? Various maturing T-Bills, stock sales all done at various times and for different amounts are not reasonably predictable either?

Things like a stock pays a set dividend every quarter is reasonably predictable?

Also it say a state MAY do it like this, not must, so it depends on what your state has decided for a methodology.

Things like a stock pays a set dividend every quarter is reasonably predictable?

Also it say a state MAY do it like this, not must, so it depends on what your state has decided for a methodology.

Last edited:

bigriver

Dryer sheet aficionado

- Joined

- Feb 24, 2020

- Messages

- 41

Not sure how ACA works elsewhere but there are reps here in Tennessee that you can contact. Just create an account and I remember seeing agents in my area. They get some referral fee from the insurance company or commission.

Again in Tenn you could drop COBRA and go to ACA. I did 3 months and dropped it and got on ACA.. good luck

Again in Tenn you could drop COBRA and go to ACA. I did 3 months and dropped it and got on ACA.. good luck

LakeRat1

Recycles dryer sheets

Something to think about is Christian Healthcare Ministries ..... Self-Pay Alternative to health insurance..... I have saved over 50K in premiums over that past 9 years......

When I first joined CHM, I was paying for the gold option and another option they have....$150 per month, this same plan today costs me $257 per month..... Far less than conventional coverage

When I first joined CHM, I was paying for the gold option and another option they have....$150 per month, this same plan today costs me $257 per month..... Far less than conventional coverage

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Something to think about is Christian Healthcare Ministries ..... Self-Pay Alternative to health insurance..... I have saved over 50K in premiums over that past 9 years......

When I first joined CHM, I was paying for the gold option and another option they have....$150 per month, this same plan today costs me $257 per month..... Far less than conventional coverage

The ministry route doesn’t work for everyone. Research it carefully. It is technically not insurance. My neighbor did it and got a big surprise.

You cannot change in the fall. Once on cobra you can only come off when it ends, or for annual enrollment, so Dec 31 with an ACA plan on Jan1. If you cobra continues through Feb24, you can't say "eh, I'll drop it in October" - you are locked in.

But yes you can shop in the fall for a plan to start in 2024, and then decide which way to go.

This is good advice.

Having been on COBRA Aug '21 - Dec '22 and then switching to ACA before the COBRA end date of Feb '23, I was curious about Aerides' statement and did some research. As it turned out I "lucked in" to making my change during ACA Open Enrollment so I didn't hit the barrier of trying to end my COBRA early and outside of open enrollment. For any other readers in the OP's situation, the web page https://www.healthcare.gov/unemployed/cobra-coverage/ has a useful table that describes the circumstances under which you may switch from COBRA to an ACA Plan.

Something to think about is Christian Healthcare Ministries ..... Self-Pay Alternative to health insurance..... I have saved over 50K in premiums over that past 9 years......

When I first joined CHM, I was paying for the gold option and another option they have....$150 per month, this same plan today costs me $257 per month..... Far less than conventional coverage

I won't do the healthshare thing - too many risks and horror stories. I also found some other thing that was not insurance, but paid a set amount for a long list of health issues. I did not do that one either. My husband is very healthy and qualified for private insurance - it does not meet ACA requirements because it does not cover pregnancy.

Actually, I would say all those things ARE reasonably predictable in those future months, which is why you can't get by with using the current month, which doesn't have any/much of those despite expectations of high interest payments and dividends in the months ahead. Current monthly income makes sense, which is different than current month.As long as income is reasonably predictable, so a Roth conversion done at different times and for different amounts wouldn't be reasonably predictable and couldn't be prorated into your number? Various maturing T-Bills, stock sales all done at various times and for different amounts are not reasonably predictable either?

Things like a stock pays a set dividend every quarter is reasonably predictable?

Last edited:

60 days sounds like plenty of time for me. My COBRA is good for many months, but I plan to drop it effective end of year and switch to an ACA plan to start the new year.I could not sign up for ACA until I got in a 60 day window of my COBRA expiring. I put 59 days out on my calendar and signed up. It was pretty easy and clear how to put the ACA start date in.

Similar threads

- Replies

- 11

- Views

- 375