You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

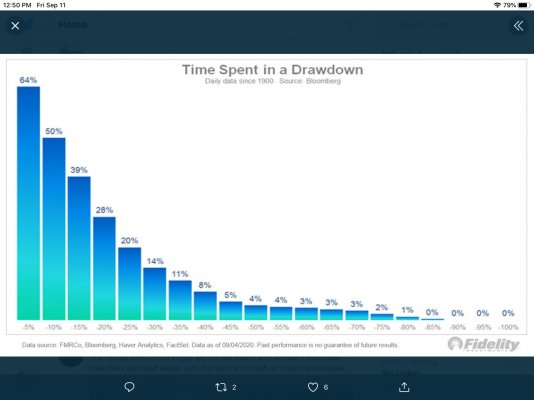

Where is the market at 64% of the time...

- Thread starter COcheesehead

- Start date

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't understand the chart. It says "time spent ... " but neither variable is time and neither of the percentages says what it is a percentage of.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,246

Naturally it's going to have that kind of curve, because anytime the market drops 10%, 15%, and so on, it's got to go through 5% first.

RetireBy90

Thinks s/he gets paid by the post

Not sure I have it down, but looks to me that 65% of the time we are down 5%, 5% of the time we are down 45%. From all time highs ?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,246

The way I read this (ignoring the confusing chart title), is that 36% of market drops (100-64) are less than 5%, 16 % (64-50) are drops of 5% up to 10%, 11% are 10-15%, and so on.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I didn’t find it all that difficult to understand. Maybe it’s easier to grasp if I said when the market declines, 64% of the time its 5%.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,990

And the point of this is ....

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I didn’t find it all that difficult to understand. Maybe it’s easier to grasp if I said when the market declines, 64% of the time its 5%.

Decline from what?

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

Don't know. Don't know what it's supposed to represent, what it's measuring, or what it means. I do like the colors.And the point of this is ....

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The point is that 5% drops are common.

Fidelity presented that chart today showing that where we are at in the market right now is the most common place since 1900...if we rebound from here.

A drawdown is a unique event, not a fluid process. So a 5% drawdown followed by a rebound happens 64% of the time.

If we continue to drop, then the drawdown percentage is a TBD and we end up somewhere down the right side of the chart.

Last edited:

Fidelity presented that chart today showing that where we are at in the market right now is the most common place since 1900...if we rebound from here.

A drawdown is a unique event, not a fluid process. So a 5% drawdown followed by a rebound happens 64% of the time.

If we continue to drop, then the drawdown percentage is a TBD and we end up somewhere down the right side of the chart.

I still am confused. Why do the percentages not add up to 100?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I still am confused. Why do the percentages not add up to 100?

Good question. Not sure.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,990

OK. It usually goes up after dropping a little. No kidding.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sorry, a career in science and engineering has not properly prepared me to understand this chart. And, if it is telling me something about the frequency of dips, it is not something that I care about very much.

We already know that the market price distribution is a skewed and distorted bell with fat tails, the left tail being fatter than the right and with values that are not independent. I guess this chart is trying to tell us something about the shape of the left side. Maybe?

We already know that the market price distribution is a skewed and distorted bell with fat tails, the left tail being fatter than the right and with values that are not independent. I guess this chart is trying to tell us something about the shape of the left side. Maybe?

Here’s a link to the Fidelity presentation that includes the chart in the OP https://www.fidelity.com/learning-c...ng/markets-sectors/stock-market-ups-and-downs

The caption beneath the chart reads thusly

The caption beneath the chart reads thusly

This chart shows the the percentage of the total number of days between 1900 and 2020 (regardless of the sign of the daily return) that in retrospect were part of a drawdown of less than X% with with X ranging from −5% to −100%. Daily data from 1900 through 09/04/2020. Source: Bloomberg.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think one of their interns was left unsupervised for too long.This chart shows the the percentage of the total number of days between 1900 and 2020 (regardless of the sign of the daily return) that in retrospect were part of a drawdown of less than X% with with X ranging from −5% to −100%. Daily data from 1900 through 09/04/2020.

jimbee

Thinks s/he gets paid by the post

- Joined

- Oct 11, 2010

- Messages

- 1,229

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,246

See post #5. Put differently, if the market is 20% down, it counts in the 5%, 10%, 15%, and 20% columns. That's why it adds up to more than 100.I still am confused. Why do the percentages not add up to 100?

Last edited:

Similar threads

- Replies

- 12

- Views

- 2K

- Replies

- 26

- Views

- 2K

- Replies

- 28

- Views

- 834