BrianB

Recycles dryer sheets

I have a situation that I haven't encountered before. I'm thinking it will involve fixed income products or an immediate annuity, but these are investment products I'm not as familiar with as I am with stocks & stock funds where most of our investments are.

(Note: The following are rounded numbers, I realize the exact numbers will be slightly different.)

We are going to receive $250k in after-tax money from the sale of our home. We're thinking to use it as part of our budgeted spending for 10 years instead of IRA withdrawals so we can be more aggressive with Roth conversions over those years while keeping our total income under the $105k limit ($80k of income + $25k standard deduction) of the 12% tax rate.

We're retired so we can't make IRA contributions.

We want $30k per year for 10 years, depleting the whole amount, which will require about a 4% yield. This will take us to our RMD years and it will allow us to convert about $60k per year total from our traditional IRA's and reduce the "tax torpedo" considerably.

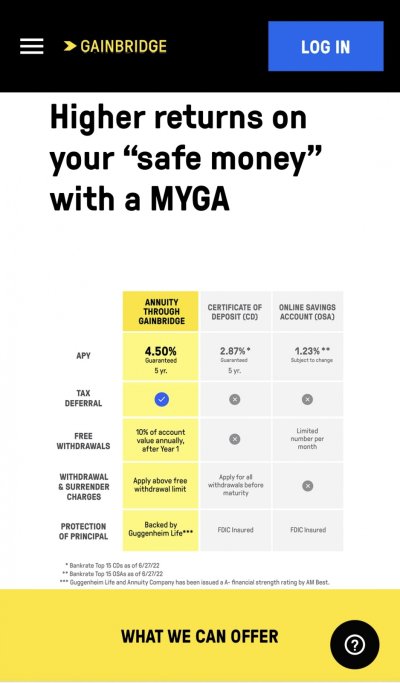

This is money we want to be "safe". It also needs to be liquid or laddered so we can get monthly or annual payments. A CD ladder? Or laddered bonds? Fixed annuity or MYGA? Something tax free like muni's (we are in Minnesota) would be a nice feature but not required.

Any suggestions for where to place this money? Or is there something in this plan I am missing that makes it a bad idea?

BrianB

(Note: The following are rounded numbers, I realize the exact numbers will be slightly different.)

We are going to receive $250k in after-tax money from the sale of our home. We're thinking to use it as part of our budgeted spending for 10 years instead of IRA withdrawals so we can be more aggressive with Roth conversions over those years while keeping our total income under the $105k limit ($80k of income + $25k standard deduction) of the 12% tax rate.

We're retired so we can't make IRA contributions.

We want $30k per year for 10 years, depleting the whole amount, which will require about a 4% yield. This will take us to our RMD years and it will allow us to convert about $60k per year total from our traditional IRA's and reduce the "tax torpedo" considerably.

This is money we want to be "safe". It also needs to be liquid or laddered so we can get monthly or annual payments. A CD ladder? Or laddered bonds? Fixed annuity or MYGA? Something tax free like muni's (we are in Minnesota) would be a nice feature but not required.

Any suggestions for where to place this money? Or is there something in this plan I am missing that makes it a bad idea?

BrianB