RetireBy90

Thinks s/he gets paid by the post

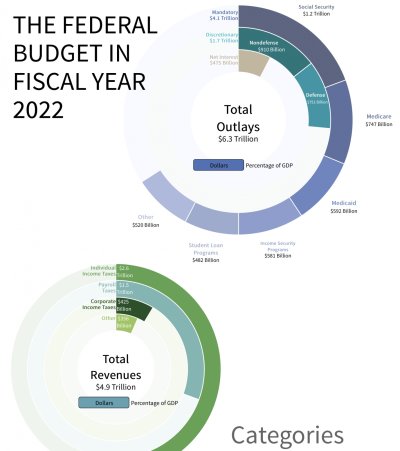

Americans PAY for social security and medicare. Its not a freebies that Government doles out of debt.

I agree, there is no dispute about the fact that SS and Medicare are deducted from every paycheck. However I finally started thinking of it as another tax from feds. If it was actually paid for by our contributions then there would be something there to claim. As it is how is SS different than the other dollars they take from one and give to another ? First SS checks were funded by workers deductions and paid to others. Same today, same as EV checks.