Can someone answer this? When looking at prices on www.healthcare.gov, a plan will increase in deductible, out of pocket and copay amounts based on the tax credit.

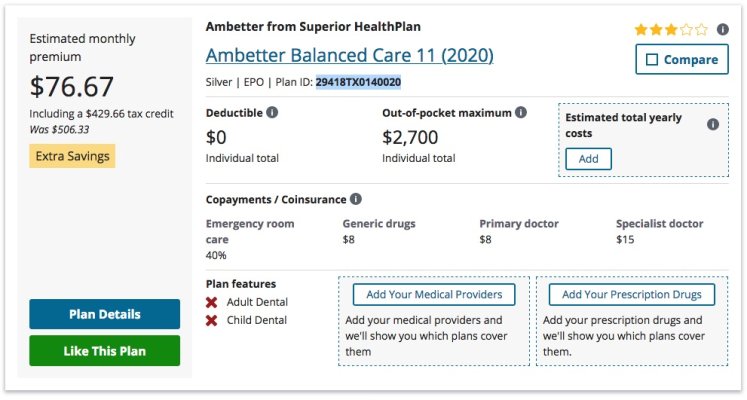

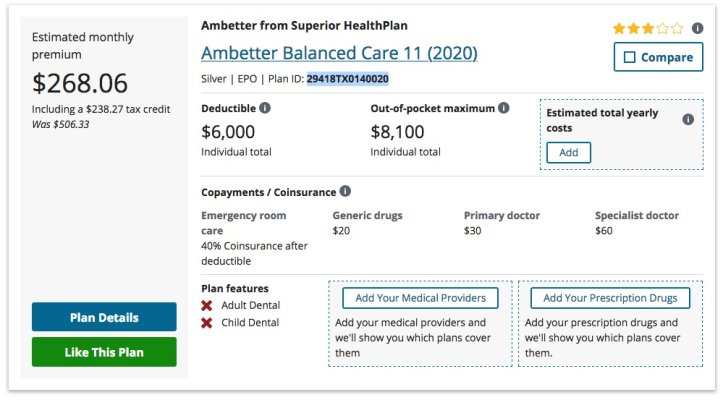

For example, I entered $20k as my income for a sinlge individual and a certain plan said the deductible was $0, out of pocket was $2700 and primary doctor copay was $8. I go back and change my income to $35k and the same plan (exact same Plan ID, plan name, etc) changes the deductible to $6000, out of pocket to $8100 and primary doctor copay to $30.

What am I missing? Screen shots attached.

For example, I entered $20k as my income for a sinlge individual and a certain plan said the deductible was $0, out of pocket was $2700 and primary doctor copay was $8. I go back and change my income to $35k and the same plan (exact same Plan ID, plan name, etc) changes the deductible to $6000, out of pocket to $8100 and primary doctor copay to $30.

What am I missing? Screen shots attached.