Normally, I am long-term optimistic, but today I turned long-term pessimistic.

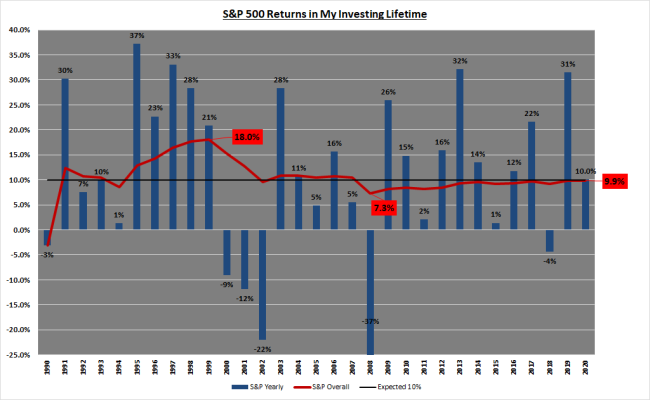

Normally, after a 10% to 20% drop so quickly, I get very optimistic. Now I see that GDP growth rates cannot be goosed so high anymore. So growth is slowing and fundamentally, stocks go up because of general economic growth. The slowdown is a long-term problem.

The short-term problems will get played out rather quickly. I think they are

1. FOMC will raise FFR tomorrow as expected.

2. Budget will get passed in some form and government will not be shutdown.

3. Trade war will take a little longer, but it will be attenuated.

4. Coal miners will die of black lung disease, so trying to keep coal mines open will become a non-issue.

5. Congress will do its job and help prevent some reckless decisions by others.

6. Brexit will not happen and another referendum will send Europe into a tizzy which is a positive.

So short-term looks excellent, but longer-term of 2 to 3 years out doesn't look good to me.