USGrant1962

Thinks s/he gets paid by the post

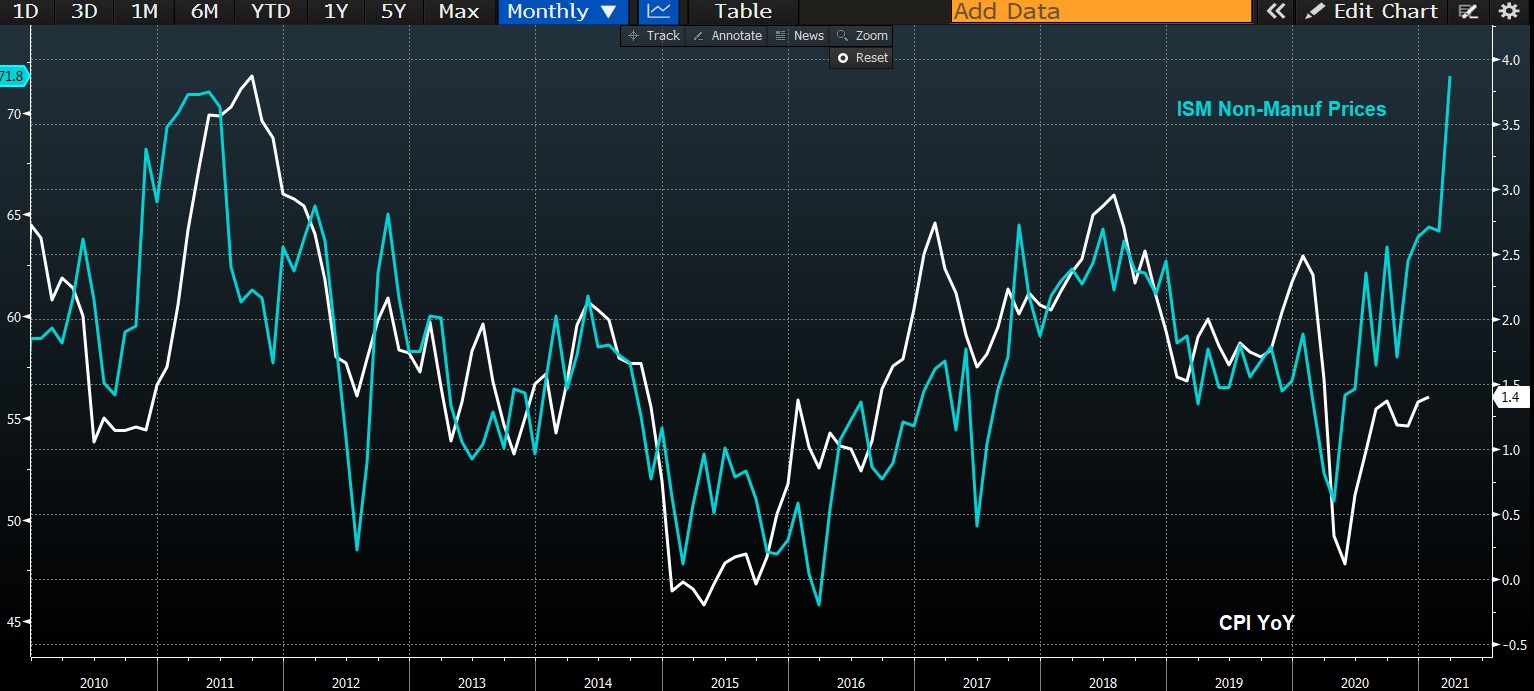

Well, my comment was primarily aimed at the notion, popular for the last 30 years or so, that government deficits (money supply) always lead to massive consumer inflation. I suggest that is not true unless there is also a shortage of goods - which has not seemed to be the case in a macro sense since the oil crisis.

As far as the short term effects of Covid, consumable goods that were not produced and not consumed last year cannot lead to inflation next year. I think the "huge lack of goods and services" were mostly consumables, not durable goods. There was some of the latter, but Covid mostly crushed services like hospitality and restaurants. I hope people eat out and travel twice as much after Covid to make up for a lost year (and a half?), but it seems highly unlikely.

But in the overall scheme of things, Covid is just a short term disruption and might even be deflationary if some of the behavior patterns stick around causing a fall in aggregate demand for restaurants, travel, office space, gasoline, etc.

As far as the short term effects of Covid, consumable goods that were not produced and not consumed last year cannot lead to inflation next year. I think the "huge lack of goods and services" were mostly consumables, not durable goods. There was some of the latter, but Covid mostly crushed services like hospitality and restaurants. I hope people eat out and travel twice as much after Covid to make up for a lost year (and a half?), but it seems highly unlikely.

But in the overall scheme of things, Covid is just a short term disruption and might even be deflationary if some of the behavior patterns stick around causing a fall in aggregate demand for restaurants, travel, office space, gasoline, etc.