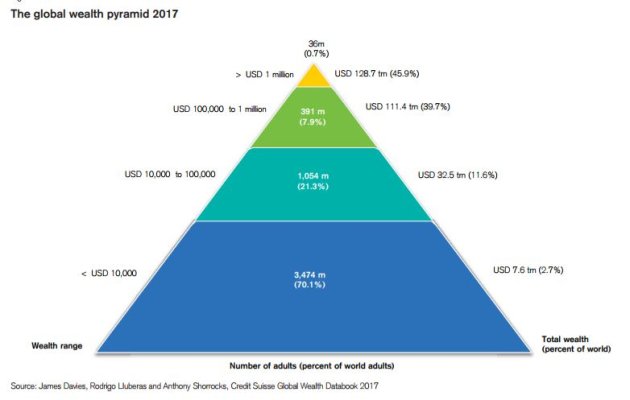

Looking at the bottom of the wealth distribution, 3.5 billion people – corresponding to 70% of all adults in the world – own less than USD 10,000. Those with low wealth tend to be disproportionately found among the younger age groups, who have had little chance to accumulate assets, but we find that Millennials face particularly challenging circumstances compared to other generations. Although relatively less severe in some emerging markets, capital losses during 2008–2009, high unemployment, tighter mortgage rules, growing house prices, increased income inequality, less access to pensions and lower income mobility have dealt serious blows to young workers and savers and hold back wealth accumulation by the Millennials in many countries. With the baby boomers occupying most of the top jobs and much of the housing, Millennials are doing less well than their parents at the same age, especially in relation to income, home ownership and other dimensions of well-being assessed in this report. While Millennials are more educated than preceding generations (we see an increase of more than 20% in tertiary education across OECD countries), we expect only a minority of high achievers and those in high-demand sectors such as technology or finance to effectively overcome the “millennial disadvantage.” We also note that entrepreneurship, as measured by the fraction of self-employed workers, has been declining across OECD countries since the turn of the century, including Millennials who are generally touted as a generation of entrepreneurs.