Sarah in SC

Moderator Emeritus

If you use Mint, they are also offering the score.

I qualify at Barclays to get my score as well.

They are kinda close, as is the one at CreditKarma, which I also use.

And thrice yearly, I check the credit reports.

Like Fuego and athena, I am an active mileage hound for various cards, so have to keep up with it a bit more than most folks.

I qualify at Barclays to get my score as well.

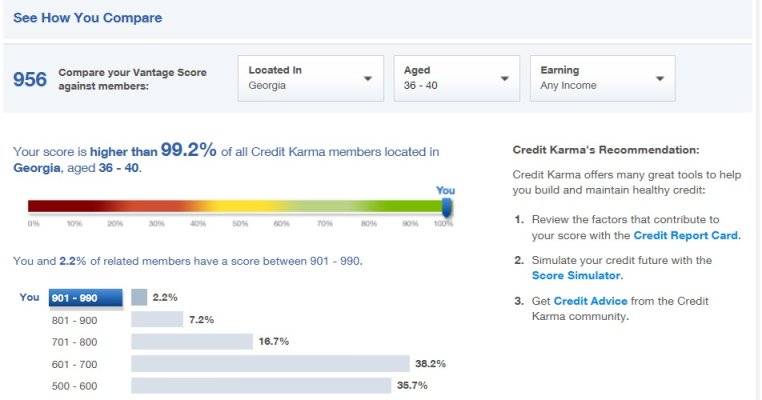

They are kinda close, as is the one at CreditKarma, which I also use.

And thrice yearly, I check the credit reports.

Like Fuego and athena, I am an active mileage hound for various cards, so have to keep up with it a bit more than most folks.