travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

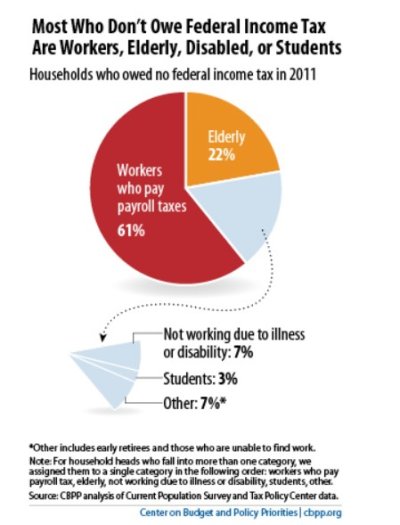

Interesting article showing historical data on where the budget comes from and where it goes, in mostly graphical format.

How We Pay Taxes: 11 Charts - Derek Thompson - The Atlantic

How We Pay Taxes: 11 Charts - Derek Thompson - The Atlantic