I used to do some repairable insurance sale cars and we paid the sales tax on what we paid for the cars. they changed that to the sales tax on the book value of the car, so Iowa is catching up. it won[t be long before it is like Illinois.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Illinois Imposing Car Trade-In Tax On Jan. 1; Dealers Call It Double Taxation

- Thread starter rk911

- Start date

VanWinkle

Thinks s/he gets paid by the post

I would never trade in a car anyway. Private sales only. Dealers ALWAYS try to hose you on a trade.

This might help those sales lots that take vehicles on consignment to sell for the owner instead of trading in to dealer. This will raise the taxes on a new car deal over 1000.00 for each vehicle purchased with a 3 year old trade.

Tennessee is looking better every day.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

1) Have you ever run a business? To sell a used car at a profit, you have to buy it below retail with enough margin to cover your costs and risks.I would never trade in a car anyway. Private sales only. Dealers ALWAYS try to hose you on a trade.

2) Statements that use a naked "never" or "always" are almost always false.

3) Selling or trading a used car is much more nuanced than your simple statement comprehends.

CRLLS

Thinks s/he gets paid by the post

I must have been one of the lucky ones. I bought a new car in a different Illinois county than mine. During the transaction, I told the dealer that I was in DuPage county and the tax was higher. He knew nothing about that and ran the transaction at this local tax rate. I never received a bill from my county or the state for the extra $$. ( Shhhh. Don't tell anybody)No, I tried that.

Bought the new vehicle, paid the lower tax where the dealer was located.

Six months later I get a bill from the State for the rest of the sales tax because I was located in a higher tax rate city than the dealer.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,084

I always sell my cars. The only exception was a 14 year old Volvo that I traded in because it needed 6k in repairs. I didn’t want to sell that car to someone.

CRLLS

Thinks s/he gets paid by the post

I treat every trade in as a separate negotiation from the new car purchase. Deal on the new car purchase and then deal on the trade in. I have been known to keep a few cars until they are no longer safe or uneconomical to repair. In these cases, I am too leary of selling them to a private buyer. In recent 2 cases, I have gotten wholesale price or better on the "trade-in" that goes immediately to the wholesale auction block. I feel that I am somewhat more isolated from the eventual buyer that way. They were probably parted out by a salvage yard. I give you that this is definitely a different scenario than trading in a $10K car.I would never trade in a car anyway. Private sales only. Dealers ALWAYS try to hose you on a trade.

aja8888

Moderator Emeritus

Tax is 6% in Michigan and it’s always been that way. You pay tax on the entire value regardless of any trade in or whatever. The only situation I’ve heard that I consider worse is in Texas where I understand that when you lease a car, you pay sales tax on the entire value of the car. In Michigan, you only pay the sales tax on the lease payment. You pay it each month as a component of the lease payment.

Yep, here in the Great State of Texas you pay the full sales tax on a lease vehicle. Dealers try to hide that cost in the "down payment" for the lease. Most ads say $XXX per month then in fine print below say "After $X,XXX down payment.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Yep, here in the Great State of Texas you pay the full sales tax on a lease vehicle. Dealers try to hide that cost in the "down payment" for the lease. Most ads say $XXX per month then in fine print below say "After $X,XXX down payment.

Two rules for living in Texas:

1. Don't squat with your spurs on.

2. Don't lease a vehicle - or transfer one leased out of state.

My BIL was really miffed a few years ago when he moved to TX from Ohio and when he registered his car in state was hit with a bill for $1,500 in taxes. He was in the middle of a 3 year lease and had to pay sales tax (6.25%) on the full price of the car at the time he signed the lease, less a credit for the tax he'd already paid each month.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Exactly my point when I said that the trade-in decision was nuanced. I have traded a couple of cars where I did not want the next owner to know my name and address. I remember one old Volvo I got a decent trade price for then, after the deal was done, the used car manager asked "How is that car, anyway?" My answer was "It's a rat." This produced a very crestfallen used car guy and a car that was, I'm sure, immediately wholesaled.I treat every trade in as a separate negotiation from the new car purchase. Deal on the new car purchase and then deal on the trade in. I have been known to keep a few cars until they are no longer safe or uneconomical to repair. In these cases, I am too leary of selling them to a private buyer. In recent 2 cases, I have gotten wholesale price or better on the "trade-in" that goes immediately to the wholesale auction block. I feel that I am somewhat more isolated from the eventual buyer that way. They were probably parted out by a salvage yard. I give you that this is definitely a different scenario than trading in a $10K car.

Another scenario is trading a nice dealer-maintained car to a dealer who has all the maintenance records. To him and to a potential buyer this car is more valuable than retail book. Hence a good seller/negotiator may be able to get above wholesale book for it.

Tiger8693

Full time employment: Posting here.

Two rules for living in Texas:

1. Don't squat with your spurs on.

2. Don't lease a vehicle - or transfer one leased out of state.

My BIL was really miffed a few years ago when he moved to TX from Ohio and when he registered his car in state was hit with a bill for $1,500 in taxes. He was in the middle of a 3 year lease and had to pay sales tax (6.25%) on the full price of the car at the time he signed the lease, less a credit for the tax he'd already paid each month.

So let me get this right: If I live in another state (say, SC where I grew up) and bought a car 2-3 years ago paying the State tax required there (max of $300 due to the annual property tax costs for having a vehicle), and then I move to Tx, they will go back to the original purchase price and want to charge me Tx state tax for that purchase??

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

So let me get this right: If I live in another state (say, SC where I grew up) and bought a car 2-3 years ago paying the State tax required there (max of $300 due to the annual property tax costs for having a vehicle), and then I move to Tx, they will go back to the original purchase price and want to charge me Tx state tax for that purchase??

I think you summed it up correctly.

Here is a description of the calculation:

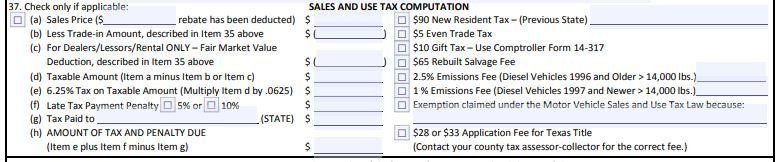

Computation of Motor Vehicle Sales Tax

1. Texas Sales Tax is 6 1/4% of the sales price or 80% of the SPV (Standard Presumptive Value) , whichever is greater

2. The price you paid or consideration given for the vehicle

3. Amount of tax paid to another STATE (local taxes included are not considered for credit purposes) (include a copy of your PAID Tax Receipt IN YOUR NAME for this amount)

4. The Amount you owe is the difference between the amount in #4 and the amount of STATE ONLY tax previously paid in another state. If this figure is -0- (ZERO) or less you owe no tax

Exactly how my lease is - not MI.Tax is 6% in Michigan and it’s always been that way. You pay tax on the entire value regardless of any trade in or whatever. The only situation I’ve heard that I consider worse is in Texas where I understand that when you lease a car, you pay sales tax on the entire value of the car. In Michigan, you only pay the sales tax on the lease payment. You pay it each month as a component of the lease payment.

I always give them to young relatives or St. Vincent dePaul.I always sell my cars.

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,556

I see the new law not as double taxation, but simply as a tax on the purchase price of the new car. Whether you trade one in, or pay for it in cash, shouldn't affect the tax liability. ...that's the way it is in CA: "In California you pay sales tax on the full price of the new vehicle. No allowance is made for the trade in value as in many other states." I do understand that you were used to getting the tax break, so it's hard to handle, and it will undoubtedly affect new car sales. Less incentive to trade in, now! Better to sell privately, now!

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,556

Have you ever received a fair trade-in offer on your used car, that didn't come with a) a high finance % rate, or b) a new vehicle purchase price that was at or above MRSP?1) Have you ever run a business? To sell a used car at a profit, you have to buy it below retail with enough margin to cover your costs and risks.

2) Statements that use a naked "never" or "always" are almost always false.

3) Selling or trading a used car is much more nuanced than your simple statement comprehends.

My last couple of attempts at trading in resulted in low Blue Book offers. The last time, I negotiated the purchase price first, then after reviewing the offered trade-in value, laughed, and told them they weren't getting my trade-in.

Last edited:

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

If this is true, it must be fairly recent. I don't recall paying any such tax when I moved to TX in 2001 and registered a car I bought in NC 4 years earlier.So let me get this right: If I live in another state (say, SC where I grew up) and bought a car 2-3 years ago paying the State tax required there (max of $300 due to the annual property tax costs for having a vehicle), and then I move to Tx, they will go back to the original purchase price and want to charge me Tx state tax for that purchase??

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Indiana taxed the difference in value between the trade-in and the new car. Some dealers would charge $150 or so to transfer ownership if you found a buyer yourself and you’d still get credit for the trade.

- Joined

- Nov 27, 2014

- Messages

- 9,208

So let me get this right: If I live in another state (say, SC where I grew up) and bought a car 2-3 years ago paying the State tax required there (max of $300 due to the annual property tax costs for having a vehicle), and then I move to Tx, they will go back to the original purchase price and want to charge me Tx state tax for that purchase??

If this is true, it must be fairly recent. I don't recall paying any such tax when I moved to TX in 2001 and registered a car I bought in NC 4 years earlier.

Someone may want to clarify. The thread went from this happening when you lease and drifted to when you own a car outright. I’m not sure but I don’t think it applies to when you own a car, but it might.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Someone may want to clarify. The thread went from this happening when you lease and drifted to when you own a car outright. I’m not sure but I don’t think it applies to when you own a car, but it might.

Yes, it does apply when you transfer/register an owned motor vehicle into the state.

When registering a motor vehicle in TX that was purchased out of state, you must pay 6.25% in sales tax, less any sales taxes paid to the purchasing state. The tax is based on the sales price of the vehicle without regard to when it was purchased.

To confirm, here is the sales tax computation section from TXDot Form 130 U, "Application for Texas Title and/or Registration".

Attachments

Last edited:

- Joined

- Nov 27, 2014

- Messages

- 9,208

Wow. That’s pretty darn aggressive. Of course, one needs to consider the entire tax burden and I think Texas still does well on that measure but from just looking at a vehicle, that’s a bit much. Thanks for the confirmation.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, start with "What is "fair?" AFIK there are no line judges in tall chairs calling "fair" or "unfair." A deal happens only when the deal acceptably meets the needs of the seller and acceptably meets the needs of the buyer. I don't know how "fair" figures into that.Have you ever received a fair trade-in offer on your used car, that didn't come with a) a high finance % rate, or b) a new vehicle purchase price that was at or above MRSP?

Re "high finance % rate" I have no idea. I took out my first and last car loan fifty years ago and I hated it. Since then we have only bought cars that we could pay for. (Unusual concept, I know.) To me the only thing dumber than borrowing to buy a depreciating asset is to lease it, which at the bottom is just a complicated and opaque way to borrow.

Re "purchase price above MSRP" again I have no idea. The single time that MSRP has been in an equation was for my 1994 K1500, which I bought for $500 over invoice because it worked out to be cheaper than all of the 1 year old similar trucks on the used car lots.

Now that we are old and comfortable, the last three or four cars we have bought have been 1 model year old, still on the dealers' lots. We are used to paying far below MSRP. My best deal was my Mazda RX-8 at $18,500 vs MSRP of $28,000.

With respect, I think you do not understand business. Also, it sounds like you have a lot of ego involved when negotiating. As a negotiator I kind of like this because I can feed the ego to get the deal rather than giving up so much on price. I will weep and wail and tell you what a tough negotiator you are. I will leave the room, supposedly to talk to my sales manager, have a coffee, and return with a sad story of suffering. I will seat you at the head of the conference table so you feel powerful. I will do lots of things that cost me nothing and lead to what the behavioral economists call "transaction utility" -- the pleasure you feel when you think you are getting a deal. So ... be careful out there!My last couple of attempts at trading in resulted in low Blue Book offers. The last time, I negotiated the purchase price first, then after reviewing the offered trade-in value, laughed, and told them they weren't getting my trade-in.

Tiger8693

Full time employment: Posting here.

Wow. That’s pretty darn aggressive. Of course, one needs to consider the entire tax burden and I think Texas still does well on that measure but from just looking at a vehicle, that’s a bit much. Thanks for the confirmation.

Yes, to me, it's a money grab, pure and simple.

Now, I can understand if someone goes out of state to try and avoid the state tax (live in Tx, buys out of state, then tries to register in Tx), but for someone that has moved to Tx from out of state, and having owned a vehicle several (2,3 or 5 years.... sorry, that's just bull$#!^. I mean, if you bowght it 10 years ago are they going to go all the way back to the original purchase and tax it?

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Good thing state income taxes aren't money grabs.Yes, to me, it's a money grab, pure and simple.

Similar threads

- Replies

- 6

- Views

- 1K