might depend on where in south florida you are looking. considering the three counties which make up south florida and assuming a bottom can ever be called: palm beach county is either at or close enough to touch bottom; broward is either at or at least can see bottom; miami-dade might not be close enough to even see bottom yet.

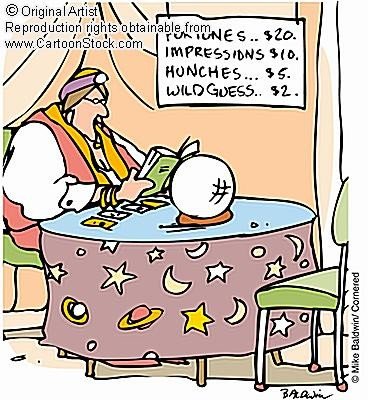

i'm making the broward bottom crystal ball call living in an area where there are very few single family houses available for sale. my friend, just miles away, living in an area with many for sale signs does not see bottom through my rose colored crystal ball and he is stunned by the asking prices which are lower than my area though during the upswing they were much higher. he thinks his house will be worth 10% less next year whereas i think my area will simply lose to inflation over the next few years. living in a gay ghetto has insulated me just a little from the downturn.

but any of that dependents not only on individual area within each county, but also on individual street & house. my feeling is a lot of us who were serious to sell & at least somewhat realistic priced down quickly. i took 30% off the top on the inherited house, effectively wiping out bubble gains. i figure a 32% paper loss on my personal house, both of which i hope to sell within the next year or three (however long it takes).

according to deutsche bank in

Housing weakness is spreading, will be prolonged: Deutsche Bank - MarketWatch

After examining the February data, Deutsche Bank said home-price declines accelerated to 9% year-over-year, the highest figure recorded to date, with formerly hot markets in Florida and California the hardest hit. The analysts reiterated their belief that home prices will fall in the 20% to 25% range, peak to trough, before there is light at the end of the tunnel.

foreclosures seem to be priced anywhere from 30 to 50% off the high water line. so of course until they are gone non-foreclosed houses are going to be tough to get a much better price. buyers keep waiting in for a foreclosure to come up in the area where i've the inherited house but it is such a monied area that such a sale is unlikely. so i'm told there are a lot of buyers waiting on the sidelines. once i sell here and take a breath from real estate for a while, i might come back to northern florida if there are foreclosures left to buy in a few years.

to get an idea if the area you are looking at is at least decelerating downward, you might want to check out

DQNews - DataQuick Real Estate Headlines and Statistics which reports quarterly based on zip code. though if you are looking for something near a tri-rail station, i would imagine steeper declines due to greater foreclosures in those areas within those zip codes.

edit: concerning condo in florida. if your brother lives in miami and you want to spend that kind of money, there are some new condos built adjacent to the metromover (which hooks up to metrorail & tri-rail) in the downtown area. in fact i believe there is one building built around the track with a station right inside. a word of caution on buying condo now is that many are being bought in bulk by vulture venture groups which then take over the association and convert the building to rentals. and even if that is not the case, i imagine maintenance fees could go a little crazy if many units remain unsold. anyway, will search for building i'm thinking of and post if i find same. would be perfect for your borther.

got it. nice prices too. damn, might consider it myself.

the internet: making life too easy...

Loft Downtown II Condos

just noticed, cohen freedman encinosa architects. used to deal with them in my past life. very talented firm & nice guys ta'boot.