TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

This topic is an update to the Teenage/Money Issue thread of last October. I'm posting it in case it's useful to others with kids in college.

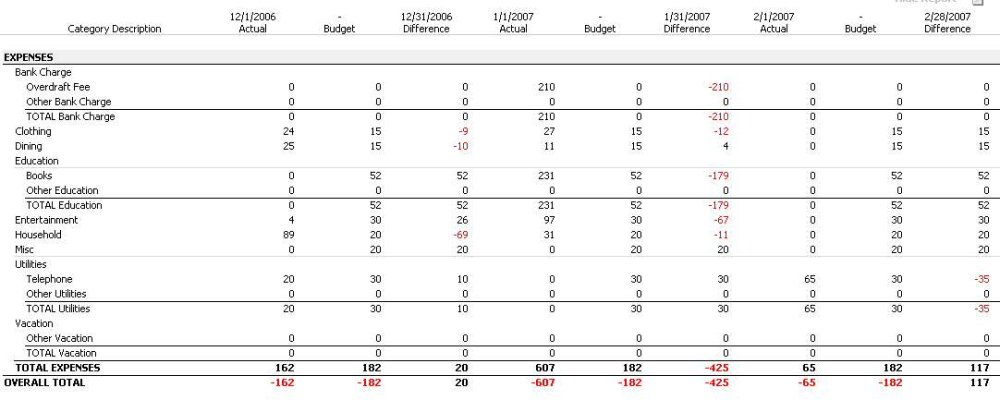

Update Summary: She's kept to her budget, but hasn't managed her money well, and recently had another series of bank overdrafts. She's made her $50 loan payments, but some of them have been late.

I thought that her overdrafts from last summer would have taught her her lesson, and she would never bounce another check again. But that was wrong. I'm now requiring her to track her money more carefully. We installed Quicken on her laptop over Christmas, and she's required to send me budget reports every month.

Her job (she works at a call center, calling alumni and soliciting donations (I know, my daughter's a telemarketer! )) has brought in about $300 per month. She's always on the edge of being totally broke.

)) has brought in about $300 per month. She's always on the edge of being totally broke.

Her attitude with the checking account was "I just use my debit card, so I don't need to reconcile." Now she's learned that that doesn't work, and I'm making sure that she reconciles regularly. She also didn't write down expenditures in a register. I'll say "What was this $16 check for?" and she'll say "I have no idea -- let me go online and view the check image -- oops, it's too old, and there's no image."

She now has a credit card that will handle overdrafts

. We'll see what happens there.

. We'll see what happens there.

THIS SUMMER

No loan this summer. I'm giving her $400 for startup expenses. She has a possible one-month internship at the Karolinska Institute in Sweden (DW's family is Swedish). Current tentative plan is that she flies to Sweden, does the internship and gets a job for the other months. This could happen because her grandparents want her to come there and would pay for the flights. She would live with them.

She knows that if she doesn't bring in some bucks from the summer, she'll be on the same austere budget as this year.

Stay tuned.

Update Summary: She's kept to her budget, but hasn't managed her money well, and recently had another series of bank overdrafts. She's made her $50 loan payments, but some of them have been late.

I thought that her overdrafts from last summer would have taught her her lesson, and she would never bounce another check again. But that was wrong. I'm now requiring her to track her money more carefully. We installed Quicken on her laptop over Christmas, and she's required to send me budget reports every month.

Her job (she works at a call center, calling alumni and soliciting donations (I know, my daughter's a telemarketer!

)) has brought in about $300 per month. She's always on the edge of being totally broke.

)) has brought in about $300 per month. She's always on the edge of being totally broke.Her attitude with the checking account was "I just use my debit card, so I don't need to reconcile." Now she's learned that that doesn't work, and I'm making sure that she reconciles regularly. She also didn't write down expenditures in a register. I'll say "What was this $16 check for?" and she'll say "I have no idea -- let me go online and view the check image -- oops, it's too old, and there's no image."

She now has a credit card that will handle overdrafts

THIS SUMMER

No loan this summer. I'm giving her $400 for startup expenses. She has a possible one-month internship at the Karolinska Institute in Sweden (DW's family is Swedish). Current tentative plan is that she flies to Sweden, does the internship and gets a job for the other months. This could happen because her grandparents want her to come there and would pay for the flights. She would live with them.

She knows that if she doesn't bring in some bucks from the summer, she'll be on the same austere budget as this year.

Stay tuned.