Finally, I have enough data to be able to contribute to this thread. STLYX* returned 0.27% in 2015.

Since I'm the kind of guy who always wants to get right to the swimsuit competition, here's what it's got:

Ticker | | | |

| FSTVX | Total Market Index | 7.38 | 7.41 |

| FSEVX | Extended Market Index | 19.57 | 18.23 |

| FCNTX | Contrafund | 18.42 | 17.12 |

| FSIVX | International Index | 13.12 | 12.25 |

| FEMKX | Emerging Markets | 6.69 | 6.14 |

| FSITX | US Bond Index | 14.73 | 17.11 |

| FINPX | Inflation-Protected Bond | 4.90 | 5.88 |

| FAGIX | Capitol & Income | 2.48 | 2.87 |

| FNMIX | New Markets Income | 2.53 | 2.90 |

| FRESX | Real Estate Investment | 10.18 | 10.09 |

| | | |

[TD]Name[/TD][TD]2015 %[/TD][TD]2016 %[/TD]

[TR][TD][/TD][/TR]

[TR][TD]

[/TD][/TR]

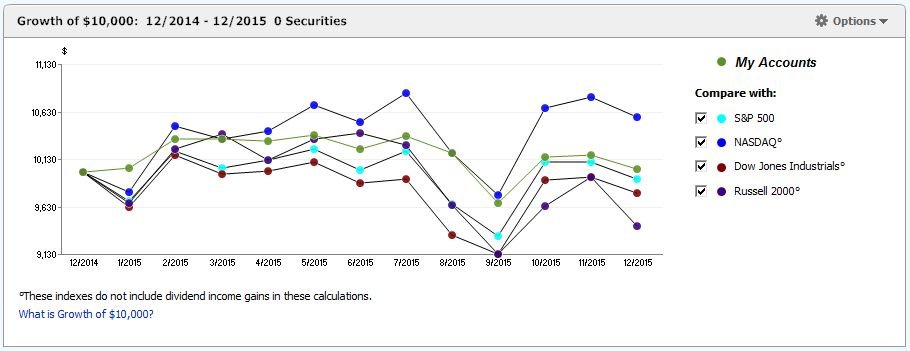

Attached is a Quicken-generated graph that shows STLYX* return (Growth of $10,000) vs. various market indexes in 2015. The reason why it's dated from 12/14-12/15 is that Quicken seems to want to plot its points at month-end, so if I start from January 2015, it misses the required distribution that I have withdrawn automatically as early as possible each year (because the point would be January 31), so this graph begins December 31, 2014.

Background: this is not my full portfolio, but an inherited IRA that came into existence in early 2013. That makes it super-easy to track returns, since there is a known starting date/value, no additions, only the IRS-required distributions each year.

I started calling it STLYX (to amuse myself, mainly), but then discovered that ticker was already taken by a (much more boring) fund, so I decided to do what they did for Roger Maris and add the asterisk.

I like several things about the pattern shown in the $10K graph, not the least of which is that STLYX* didn't take quite the nosedive as the indexes in August and September (remember that? Wasn't that China-induced also?). If that kind of pattern were to persist for the balance of my retirement (highly unlikely), I'd call it fine with me.

STLYX* is steered by the top-level stock/bond allocation determined by Vanguard's 2025 target-date fund (VTTVX, which returned -0.85% in 2015). I decided to let the "pros" dictate that split and chose Vanguard due to a comparison of similar funds a while ago. Instead of dumping it into VTTVX, I dollar-cost averaged all the initial cash over a period of two years, which ended with investing the final chunk of cash in early February 2015. Although I follow a Vanguard top-level allocation, I implement it using Fidelity fund choices that I picked, most of which I am familiar with through my former employer-sponsored retirement plans. It's not a vote for or against either, I have a separate Roth in Vanguard that's great.

Starting with the VTTVX stock/bond allocation, I subtract 5% off the top of both (10% total) and give that over to real estate, and the reason for that is from reading what I think is an excellent book: Burton Malkiel's

A Random Walk Down Wall Street (one of e-r.org's recommended reading list), in which he suggests treating real estate as a separate asset class.

Additional data from Morningstar's Porfolio X-Ray tool regarding STLYX*: the overall exoense ratio is 0.37% and the top 5 individual stock holdings (in order) are FB, AAPL, PSA, BRK.A, and SPG (as of 11/30/15).

That's my contribution to this thread for 2015. I only know a few things with certainty about 2016: first, I haven't the slightest idea what any of the returns will look like in 2016; second, I'm all done with messing with STLYX* for the rest of the year as I've received the distribution and have rebalanced to the percentages shown in the table so now I can spend the rest of the year getting more practice with the thing called early retirement; and third, the probability of me turning into a Market Timing Winged Monkey = zero.

One more thing: I got a

Wait, Wait... question: what fund (that I don't own) returned 1.35% in 2015? Hint: "Pssst...."