Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Something like this must have been posted before, but I don't remember seeing it (so maybe it's been a while). Another thread on average retirement age made me look into it, and this ties in with that thread.

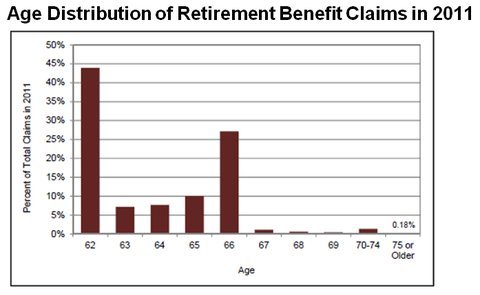

The 'peaks' at 62 and 66 (FRA for many) don't surprise me. Though I did expect the % of first claims at age 70 to be less than age 62 or FRA, I never would have guessed so few wait until age 70! With so many here planning to wait until age 70 this chart surprises me - yes, we all realize ER.org members are a small and unrepresentative minority, and plan may differ from actual. I guess the chart may be more evidence of how unusual the ER.org members are.

Bruce Bartlett: One Recession Cost Is Lower Social Security Benefits - NYTimes.com

The 'peaks' at 62 and 66 (FRA for many) don't surprise me. Though I did expect the % of first claims at age 70 to be less than age 62 or FRA, I never would have guessed so few wait until age 70! With so many here planning to wait until age 70 this chart surprises me - yes, we all realize ER.org members are a small and unrepresentative minority, and plan may differ from actual. I guess the chart may be more evidence of how unusual the ER.org members are.

Bruce Bartlett: One Recession Cost Is Lower Social Security Benefits - NYTimes.com

Attachments

Last edited: