mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,206

what prudential did is come out with a variable annuity that is really a fixed annuity but it looks good on paper.

it is a variable annuity with only one option , a bond index .

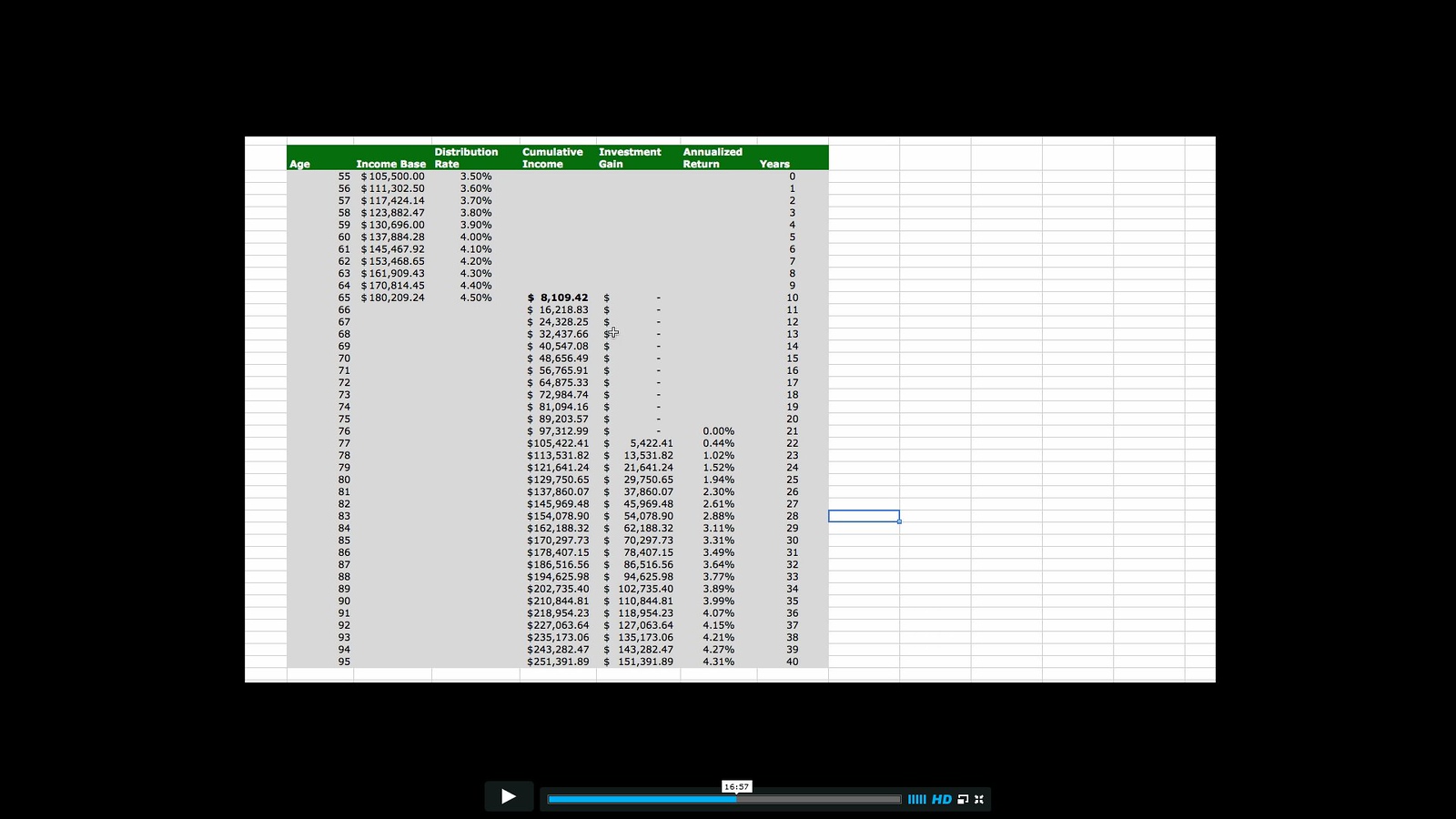

the shrewd part is they tell you for every year you delay taking withdrawals the income base amount will grow by 5.50% .

but that amount can only be used as a basis for income and not surrender or account value.

you gain a 1/10% increase in withdrawal rate for every year older you get which means although they credit the income base at 5.50% you only get to draw 1/10% of that a year as income.

it really sounds a lot better than it is,.

then depending on your age you get a guaranteed withdrawal rate as a min .

assuming age 85 or so that could get you a 3.50% return . the bond index acts as a sub account and if it goes up your income goes up , as they say.

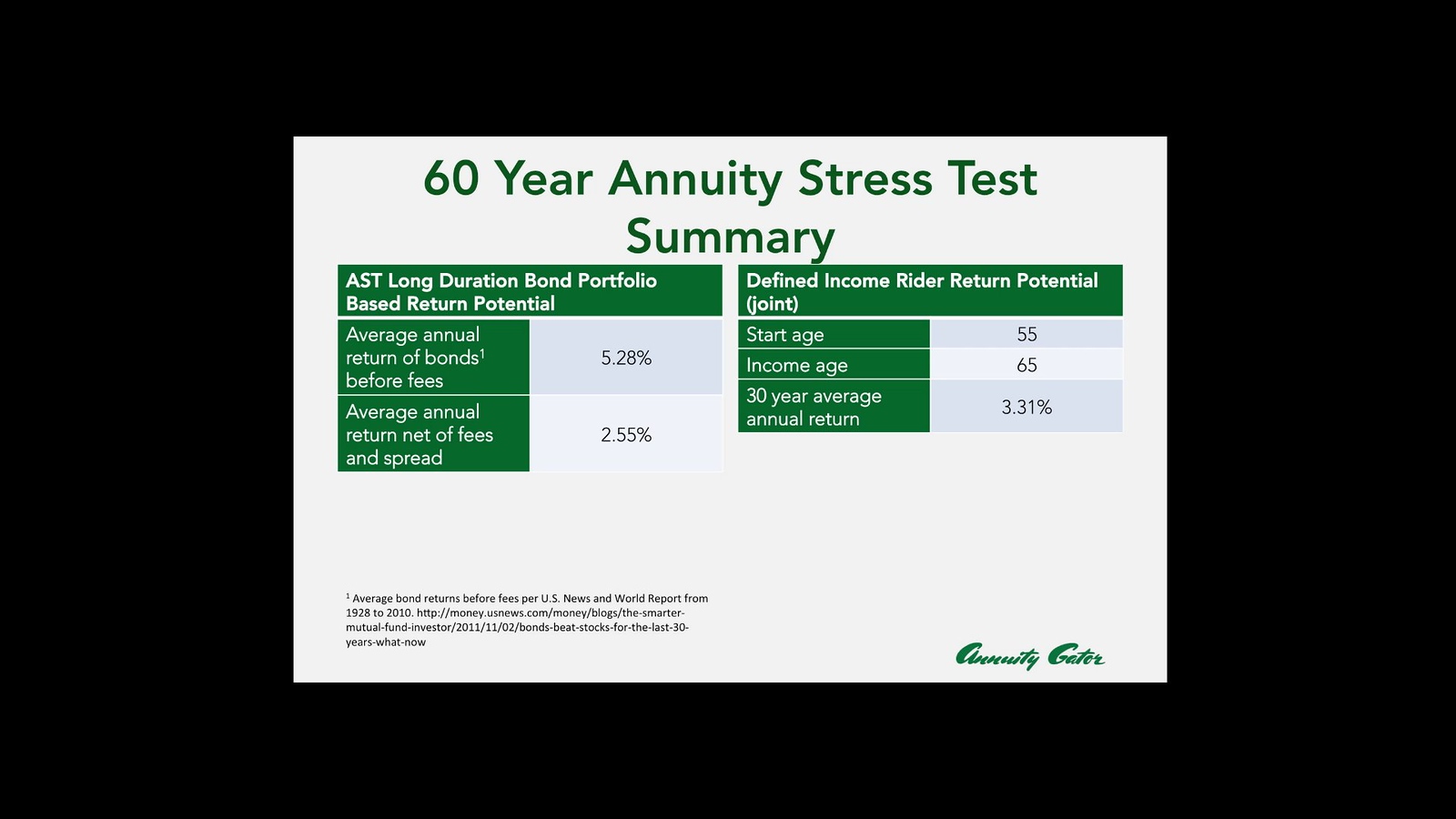

but the expenses run almost 3% and at best bonds averaged 5.25% the last 30 years so there is noooooooo way ever the bond portion will beat the guaranteed amount . so while a good selling point the reality is no way will you ever beat the income amount and get a boost from the bonds .

it is a variable annuity with only one option , a bond index .

the shrewd part is they tell you for every year you delay taking withdrawals the income base amount will grow by 5.50% .

but that amount can only be used as a basis for income and not surrender or account value.

you gain a 1/10% increase in withdrawal rate for every year older you get which means although they credit the income base at 5.50% you only get to draw 1/10% of that a year as income.

it really sounds a lot better than it is,.

then depending on your age you get a guaranteed withdrawal rate as a min .

assuming age 85 or so that could get you a 3.50% return . the bond index acts as a sub account and if it goes up your income goes up , as they say.

but the expenses run almost 3% and at best bonds averaged 5.25% the last 30 years so there is noooooooo way ever the bond portion will beat the guaranteed amount . so while a good selling point the reality is no way will you ever beat the income amount and get a boost from the bonds .