Romer

Recycles dryer sheets

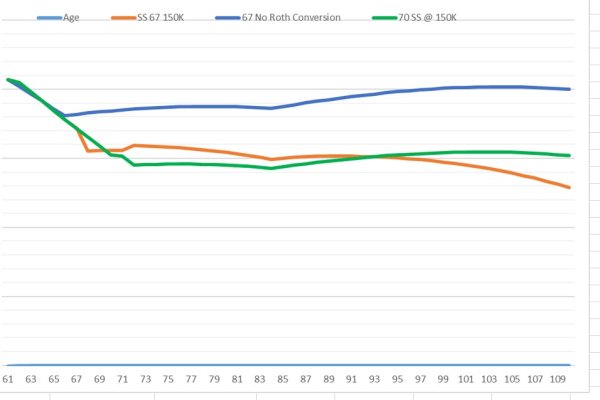

The total value of my liquid assets. It sums up my accounts; IRA, 401K, Roth, Savings, CDs

so it plots the value of my money over time against the age at the bottom for the 3 scenarios

SS at 67 with no Roth Conversions

SS at 67 with Roth conversions to top of 22% Tax Bracket

SS at 70 with Roth conversions to top of 22% tax bracket

All plotted using the same starting expense escalated every year. Includes a calculation of federal and state taxes as part of expense. Includes RMDs in Tax for expense and unused post tax RMDs go into after tax savings

so it plots the value of my money over time against the age at the bottom for the 3 scenarios

SS at 67 with no Roth Conversions

SS at 67 with Roth conversions to top of 22% Tax Bracket

SS at 70 with Roth conversions to top of 22% tax bracket

All plotted using the same starting expense escalated every year. Includes a calculation of federal and state taxes as part of expense. Includes RMDs in Tax for expense and unused post tax RMDs go into after tax savings