I know first post so take it for what it is worth. I also apologize in advance for any spelling errors

Lesson learned will actually come from how well my model tracks to reality in the future. This is about how I learned to create and update my model to hopefully cover the basis and help me make decisions ahead of time.

First off I am not a Tax expert, Financial expert and make no claims to the validity of what I am posting below. My goal here is to share the lessons learned I have from developing my own model over several years and illustrate its all about finding a balance based on your unique set of variables. You can do all this from an Excel spreadsheet fully understanding your choices rather than paying a financial planner to do this wondering if they considered everything they should

I have been modeling my retirement for a while now. Continually updating my excel spreadsheet as I saw things I didn’t consider. I am not going to share my spreadsheet as its pretty custom to my situation as yours should be. I will be retiring the end of the year

The biggest decision besides when to retire for me is what to do about my IRA for Roth Conversions and when to take Social Security

My goal is to maintain our current lifestyle and fortunately I have a pension that starts this month at 60 that helps that. That makes the choice as to when to take social security more flexible. I am down to 67 or 70

Planning Expenses:

• Before I created the detailed spreadsheet I reviewed 4 years of expenses.

• I then removed Mortgage (house paid off), 401K contributions, Health Insurance and taxes

• I then added in the Health Insurance cost I have from my employer for retiree Insurance. Just under $20K, very expensive. I wont qualify for any ACA subsidies

• II then added in other items like adding to the travel budget

• I then used 2021 Tax rates to estimate 2022 taxes

• I took the 4 years of adjusted expenses and added in Taxes and Health insurance and have a range of expenses for our current lifestyle.

• One of the years was much higher and went back in and removed wedding costs for my daughter that I hadn’t caught the first time.

• This resulted in a range that was +/- 10% from the average and so used these for planning

• I rounded up and down to provide 4 expense ranges that were equally separated but bounded the range. NOT The Graphs at the bottom

• I added these to the spread sheet column and escalated every year for inflation. I used 2%, but most others would likely do 3%. Its what you feel comfortable with reviewing what you spend money on

• Then I looked forward and how things would modify my expenses, Medicare at 65 will reduce Health care by $14K per what I have found, maybe more and I don’t expect to be doing all my same hobbies and traveling as much after 85, so slightly reduced income in that year

• This resulted in a 40 year estimation of my expenses over 4 expense rates. I have a goal rate (Expense per year) to work to, but wanted to make sure I had margin

Taxes:

• It’s hard to know if Tax Rates will change, I assumed they would not

• Tax Brackets due change. They go up 1 – 1.5% a year based on my quick estimation

• I created 4 columns for the 10, 12, 22 and 24% tax brackets and increased each year by 1%

• This was a later addition to my spreadsheet and because these brackets change the amount to convert to Roth staying in one bracket changes. Also, the impacts of RMD’s change based on where the tax brackets land. Again everyone’s situation is different that is why you need to develop and customize to your situation

• My state is a flat tax so I just modeled that in the expense

Return on Investment:

• This is the area that provides the greatest variance and one you have little control over in reality

• I see some like a 6% return. I have averaged over 12% the last 15 years, but I intend to go more conservative

• This is what I picked and you likely will pick something else. I modeled 1% (CD Rates), 2.5% and 3.9%. 3.9% was what I saw as a conservative long term rate that several “experts” that was a safe bet. I did not cover negative returns, which is a risk. I will just need to have enough in cash to work through a downturn

• I also did a stress test at 0% and verified my money would last but at a slightly reduced income until 95

• To be extra conservative, I did not consider selling my house. Again your situation will be different

Roth Conversions:

• At a high level, converting all the IRA into a Roth sounded great. I would eliminate the need for RMDs and always be in the 12% tax bracket

• In my situation, the only time this worked out to be the best option is if the ROI was 1% or lower

• That is because your ROI growing your savings is almost nil and it ends up being down to expenses

• At higher ROIs, doing the mass conversion up front lowered the amount and time my money would last

• Doing no conversions didn’t work either as the RMDs drove me to a higher tax bracket

• I modeled two types of Roth conversions: MIN: capped to the 22% bracket, MAX: Capped to the 24% tax bracket. I so no reason to model to the 32% bracket

• This why having the tax brackets escalate each year by 1% is important as it changes the thresholds for MIN, MAX or however you want to do it

• For Min, I modeled to the 22% bracket until RMDs started. I will reevaluate if I should continue them after RMDs start. The RMDs of course reduce the amount to convert to get to the 22% bracket. Being 12 years from RMD’s I figured this was good enough and my model shows the answer is different at 72 based on the ROI I actually achieve

• For Max, I did conversions to the 22% bracket until they conversion was complete resulting in no RMDs, but a significantly reduce investment balance to gain returns on

• For Max, I had a significantly reduced tax bill lowering expenses, but had a major smaller investment base to pull it from

• For Min, I had a lower tax bill than no conversions, a small RMD that fit within my expenses. Meaning I did not have to have more income than I needed

• For no conversions, the RMD drove me to have more income then I needed with the pension and social security and as a result a higher tax bil

Social Security:

• I came down to two points after running through models early on, 67 and 70

• Early models clearly showed SS at 70 is the right answer

• When you factor in Roth conversions, ROI and RMDs, in some situations 67 is actually better until about age 95 (Changes based on variables)

• I used my pension, RMDs and 85% of social security to define the taxable portion of my income along as anything else I may or may not need will now come from the ROTH

• In some cases in my situation, the Pension, RMDs and SS at 70 drove my taxable income above what I needed where as taking it at 67 would not. In these situations; Pension, RMDs and SS @67 required almost nothing from my Roth which is able to sit and grow creating a larger investment balance

• This sweet spot all changes based on your IRA to Roth situation, Resultant RMDs, having a pension and ROI

Conclusion:

It all comes down to finding the right balance for your situation. Using FireCALC is great to do a sanity check, but it doesn’t allow you to fully model your unique situation, tweaking individual variables to find the best balance and sweet spot for you

Having your own model allows you to go in and update for progress and make any modifications. I expect the answer for 67 to 70 may change based on actual performance and expenses and I know I don’t have to make that decision for a few years.

Based on my situation and models, I have decided to do min Roth conversions to the 22% bracket until age 72. At that time I can always make the decision to continue them on top of RMDs. Or, if things significantly change with a higher ROI than I expect, I may decide to switch to the max conversions (24% bracket)

I am no tax or financial expert. Just an engineer who is use to modeling all kinds of scenarios. Please don’t take anything I said her as gospel as to what you should do. My entire point in sharing this si everyone’s situation is different and using Excel to model your unique situation will help YOU find the right balance.

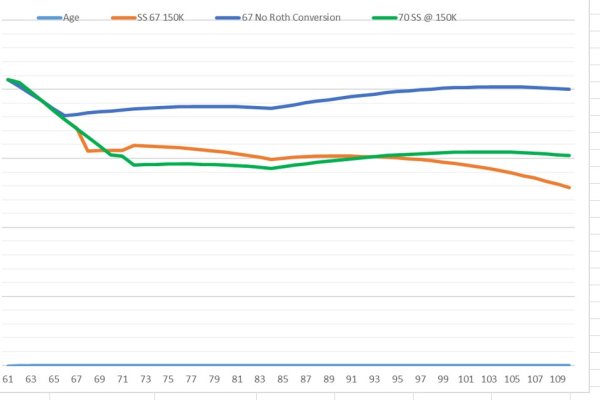

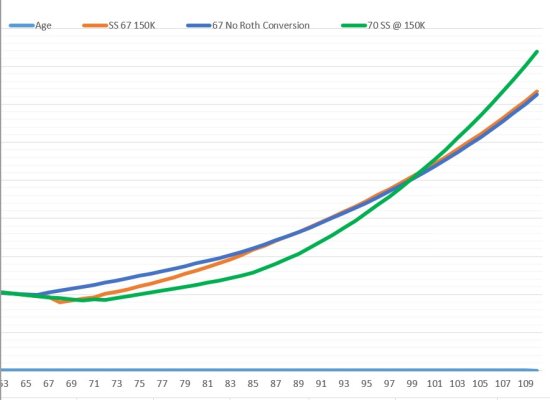

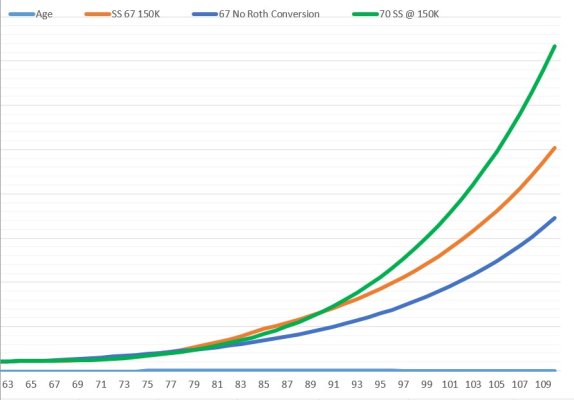

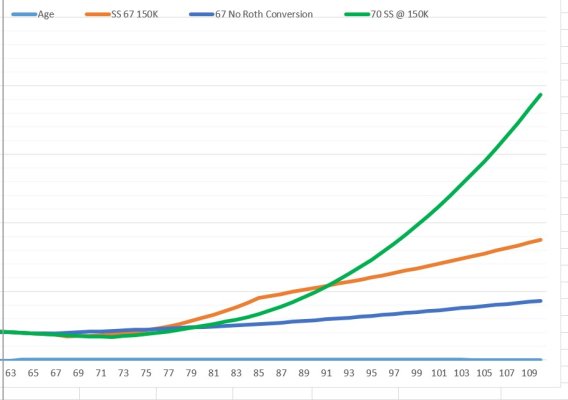

The bottom 3 graphs are of my situation to illustrate how things vary. For the 1% ROI you can see that at age 85, SS at 70 and Max Roth conversion is the best option because investment isn't growing so lower Tax expense is the better outcome for funds lasting longer

the 2.5% graph shows that the ROI is significant enough to outweigh the benefit of the lower tax of the full conversions. It shows SS at 70 overtakes SS at 67 at about age 86. No Roth conversions is the worst option as RMDs drive income above what is need

The 3.9% Graph shows the min ROTH option is the better solution as it has more base to grow with the higher ROI. Also the Higher ROI moves the date SS@70 overtakes SS@67 to about 93 years old. This shows even higher rates will move that later

Again these graphs are MY SITUATION. The answers will be different for you and to just illustrate why you should develop your own model and tweak it to evaluate multiple scenarios to find the sweet spot

Sorry for the long first post