Many years ago, before we knew better, the hubby and I bought a deferred variable annuity. It has done quite well, in spite of the exorbitant fees, but we are now at the point where we would like to protect the balance. There is a very low (under 2%, after fees) fixed cash option in our current annuity.

We are considering doing a 1035 exchange to a fixed annuity. We don't need the income and we don't want to lock in payments when we are close to RMDs for the hubby, so we are not in the market for an immediate annuity.

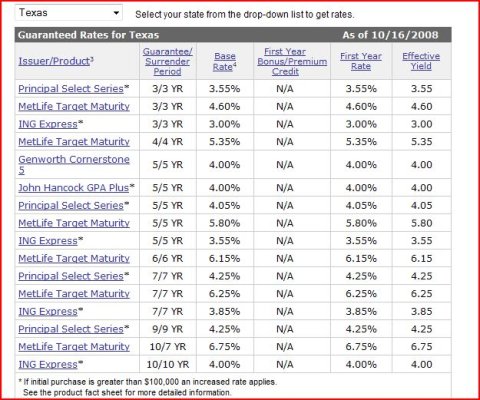

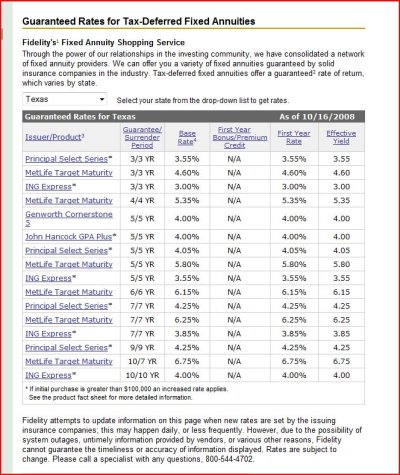

Fidelity has a MetLife 10 years fixed paying 6.75%. This sounds like a darn good deal to me right now. We are approaching this as similar to buying a 10 year CD.

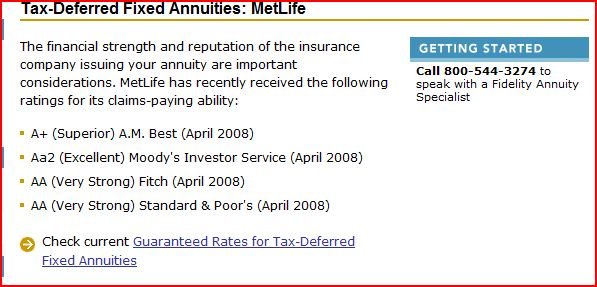

My main concern is the financial health of MetLife. I would appreciate any feedback.

We are considering doing a 1035 exchange to a fixed annuity. We don't need the income and we don't want to lock in payments when we are close to RMDs for the hubby, so we are not in the market for an immediate annuity.

Fidelity has a MetLife 10 years fixed paying 6.75%. This sounds like a darn good deal to me right now. We are approaching this as similar to buying a 10 year CD.

My main concern is the financial health of MetLife. I would appreciate any feedback.