donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

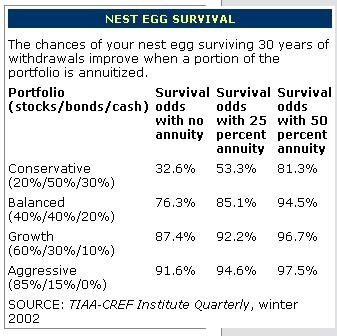

I currently have very little exposure to bonds in my portfolio. Whenever I ran Monte Carlo calculators I never could find any that showed greater survivability with the bond mix and all showed the potential for a larger estate with equities. I read Scott Burns' column this morning where he was giving good advice about using a self managed bond ladder vs funds with a 1% manager fee. He veered off at the end to argue that annuitizing part of the portfolio was good for survival. That issue is for other threads but a TIAA-CREF chart he posted showed HUGE survivability advantages for an aggressive stock based portfolio (annuity or not). I understand that bonds reduce year to year volatility but if survivability is better without them why does (almost) everyone recommend a 60/40 split?