Martha said:

We would be an investor in the entire project, not buying a unit. We make our money selling out the units when the condo conversion in complete. I think the key is how long the market will stay as hot as it is for these types of units. I am amazed people will pay a half a million for a 600 sq ft hotel room.

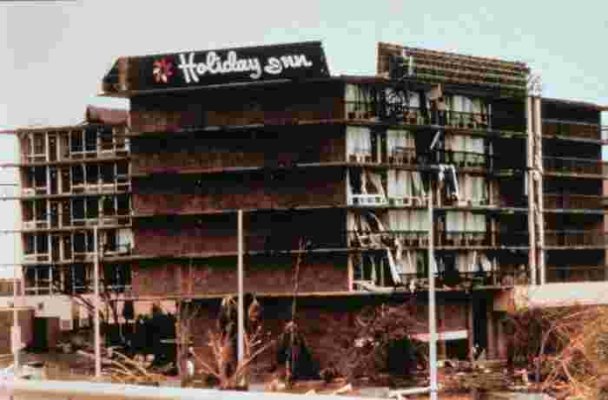

Excellent location on the beach.

"Condotels" are huge in Hawaii and a relatively recent phenomenon. Many older hotels are facing huge refurb/marketing costs and so they convert to shift the burden to the new owners. So you'll want to know what major renovations/repairs are due. A walkthrough of the industrial areas should reveal quite a bit.

La Mirage in San Diego is another example of a failed condo development. They opened in the early/mid '90s and couldn't sell out as a condo, so they went the condotel version. I don't know whether they've gone back to strictly condo or not.

Would you be invested as a TIC or some other form of ownership?

I don't know if this helps, but a fairly savvy (retired submariner) realtor in our area has been flogging a group they call the "Investment Company". Here's an excerpt from his

newsletter:

"Investment Company: The last two newsletters have discussed the Investment Company (IC) at some length. The IC specializes in working with apartment complexes ranging in size from duplexes to large complexes with hundreds of units. The IC conducts extensive research to enable their clients to be able to invest in the right area at the right time. At any given time, they have eight investment areas they recommend. These areas change frequently; e.g., over the past six months, three of their eight recommended areas have changed. The IC doesn’t own properties; they work through licensed real estate brokers in each of the recommended areas and are paid a referral

fee for providing buyers. The IC investment criteria are a 10% cash-on-cash return along with 40% appreciation over a typical holding period of 3-4 years. Last August, I went on a city tour as an observer. The local real estate company provided us information on 42 available properties of which only 13 were actually listed for sale. The

properties ranged in price from $250,000 to over $10 million with the median (mid-way) price being $800,000. All 11 of the investors on my city tour submitted offers on properties. Most of the offers were on properties either at about $300,000 to $400,000 or at about $800,000 to $1,000,000. Financing was available using a 20% downpayment. Several newsletter recipients have already made such tours. If this is of interest to you, check the applicable block on the enclosed postcard and return it; please include your phone number, as the IC will mail a free videotape to you and then call you about a week later to answer your questions."

The rest of the details are in the April & July '04 newsletters. Of course George Stott gets a referral for feeding them customers, so "Investment Company" is his pseudonym for the actual firm (whose name will be provided to you through him). He's a stand-up guy but he's also one of those senior execs who would rather sell houses (& mentor realtors) as his life's avocation rather than stay at home managing his eight-figure portfolio. ER is not a vocabulary word that he would even comprehend, let alone consider. But it's interesting that he's diversifying into nation-wide real estate rather than sticking to his "Hawaii circle of competence".

Maybe the showers are supplied with exotic mineral waters?