A heads up on looking at the ramifications of the emerging battle between Apple Pay and CurrentC.

MCX for info http://www.mcx.com/

(note the companies involved)

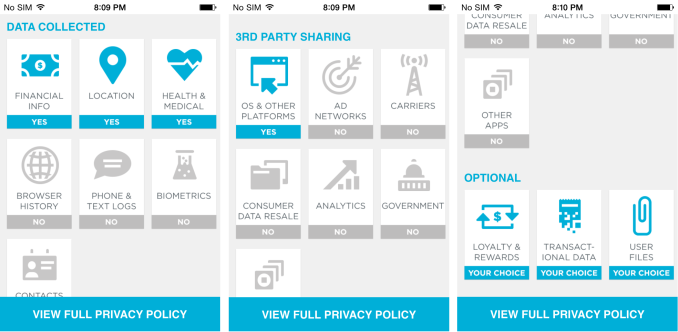

Thinking about what will be affected in the day to day handling of money, and the effect on the Credit Card industry and the Banks.

Instead of linking to a particular news article, some poking around different news and websites might be a better intro to the concept, and what it could mean to the consumer.

http://www.unfaircreditcardfees.com/

.. and members:

http://www.theverge.com/2014/10/25/7069863/retailers-are-disabling-nfc-readers-to-shut-out-apple-pay

While what we pay in hidden fees for convenience may seem small, it supports many of the major institutions. What do you see as long term consequences?

MCX for info http://www.mcx.com/

(note the companies involved)

Thinking about what will be affected in the day to day handling of money, and the effect on the Credit Card industry and the Banks.

Instead of linking to a particular news article, some poking around different news and websites might be a better intro to the concept, and what it could mean to the consumer.

http://www.unfaircreditcardfees.com/

.. and members:

http://www.theverge.com/2014/10/25/7069863/retailers-are-disabling-nfc-readers-to-shut-out-apple-pay

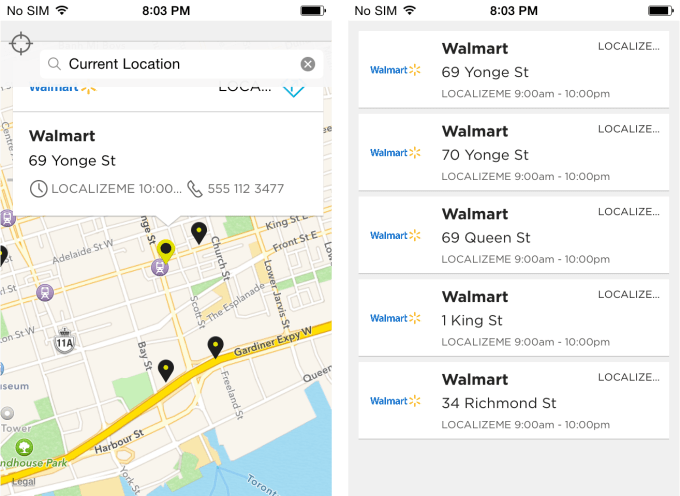

The notion of a widespread payment system controlled by retailers and free of credit card processing fees is very appealing to merchants. It should come as no surprise, then, that, in addition to Wal-Mart, the largest retailer in the world, CurrentC's partners include Gap, Old Navy, 7-Eleven, Kohls, Lowes, Dunkin' Donuts, Sam's Club, Sears, Kmart, Bed, Bath & Beyond, Banana Republic, Stop & Shop, and Wendy's — as well nearly all the major US gas station chains — among its ranks.

While what we pay in hidden fees for convenience may seem small, it supports many of the major institutions. What do you see as long term consequences?

Last edited: