MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

here's a little ray-of-sunshine to cheer you up !

Baby Boomers' Investment Returns Will Be Constrained, This Researcher Warns - WSJ.com

This phenomenon has been noted before by many other writers. All that is left is to what degree this effect will affect our livelihood.

Baby Boomers' Investment Returns Will Be Constrained, This Researcher Warns - WSJ.com

This phenomenon has been noted before by many other writers. All that is left is to what degree this effect will affect our livelihood.

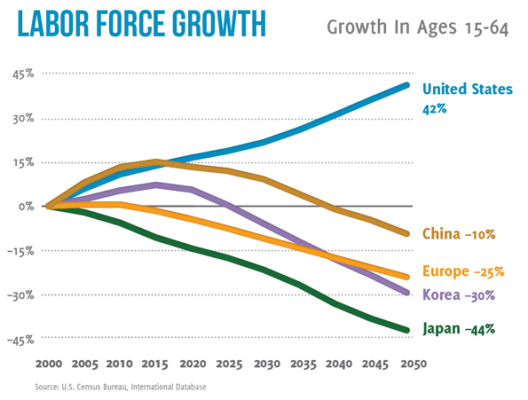

If you're a baby boomer, you've got a big problem when it comes to the investment returns you can expect in retirement: It's the sheer number of other boomers who are also getting ready to leave the workplace and rely on their portfolios to help pay the bills.

Last edited: