With high inflation, the early retiree can get hit by taxes on phony gains. Yet, managing cap gains vs. dividends could be tough, as Congress has changed laws on a whim.

The common way is to stuff one's tax-deferred accounts while working, and then to do Roth conversion after retiring. Still, people have wondered if Congress might just change the law. That has plenty of precedents.

Dividends used to be taxed as ordinary income until 2003. Cap gain tax was as high as 49.88% in 1977. Where can one hide? Our retiree most likely owns his home, hence has no deductions, and little ways to reduce his taxes. It looks bleak to me, when a "millionaire" drawing a 3.5%WR may have to live on perhaps $20K or $25K after paying taxes on the total portfolio "gain", and still sees his portfolio dwindling down after 10 years.

Now, suppose he has saved $2M so he could live on twice the amount. Ah, his "income" is now $200K/yr if he could match the inflation rate of 10%. He is now considered "rich", and will face other special tax treatments!

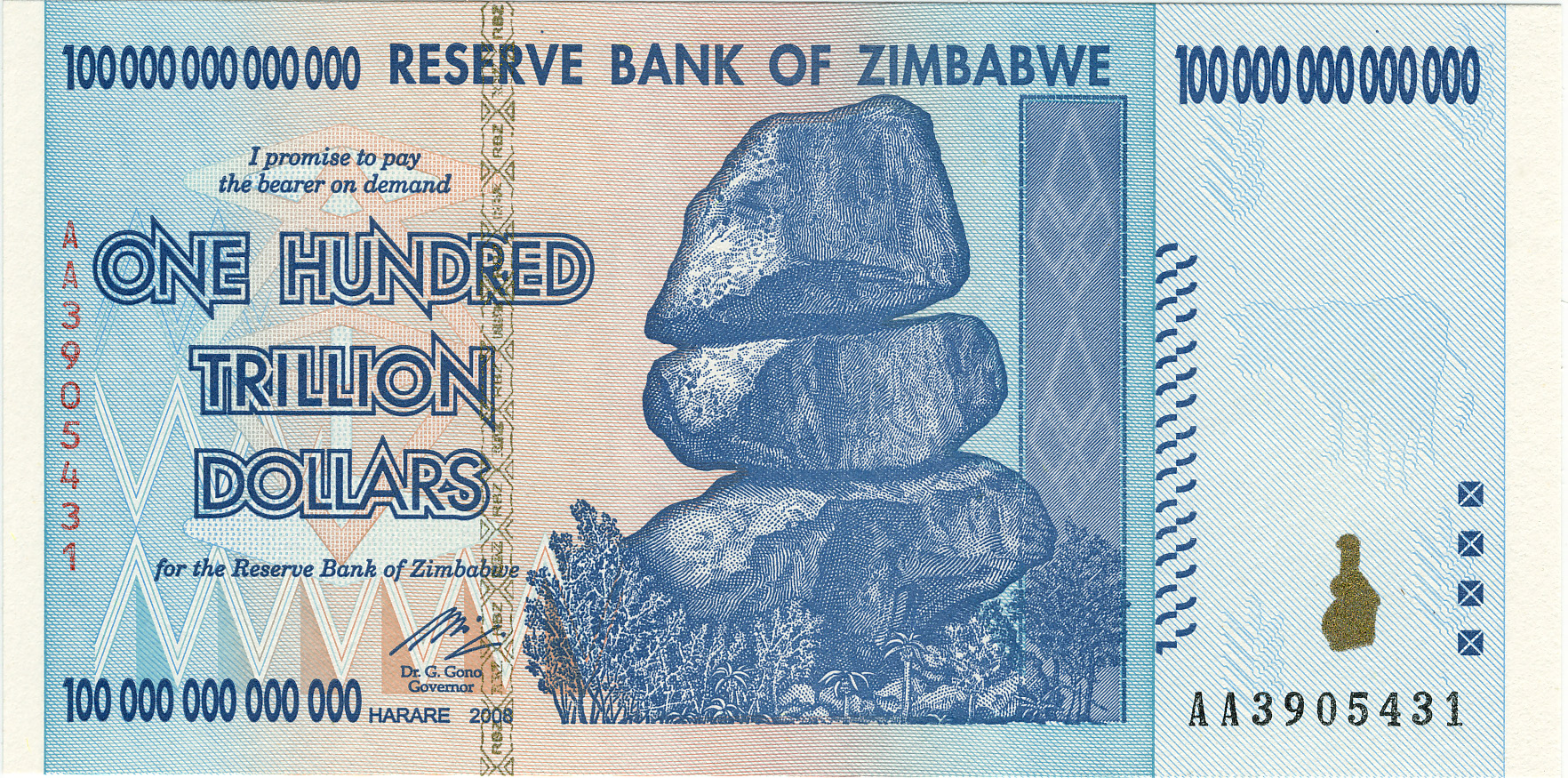

Another thing that "high income" or assets can get you is the means testing on SS. To borrow a picture that Dawg52 has posted in another thread:

"No SS for you!".

PS. People who do not "get" this picture are referred to another thread

here.