aleabo

Recycles dryer sheets

- Joined

- Jan 16, 2012

- Messages

- 63

I haven't noticed any comment about the definition of "economic security" in the study. Their minimum needs are $22,000 annually for a single renter, and $33,000 for a couple who are renting.

Note that a worker earning the minimum wage for a full-time, year-round job makes about $14,500 before taxes. And, we have hard working people in the US who earn minimum wage. That's one reason why people can arrive at 65 without much for savings.

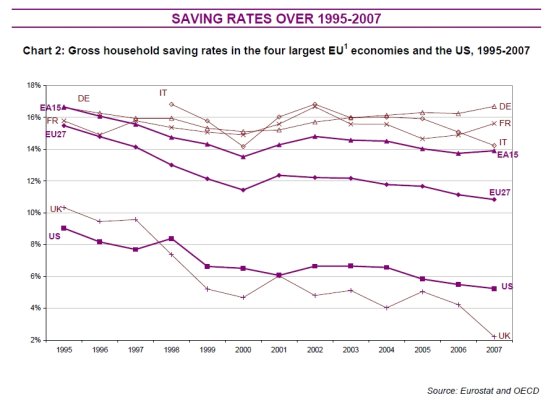

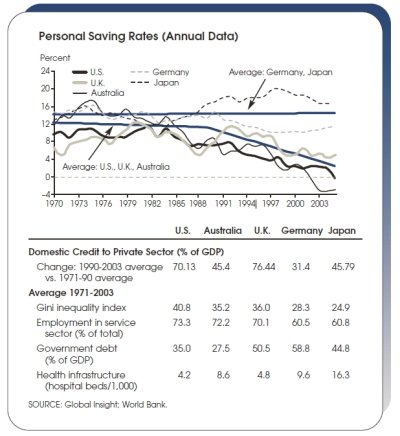

I personally think that all 401K program is big mistake, to say at least. Instead of putting 12-15% of my salary in 401K and worry about right choices, market conditions, etc, I'd be happy to have my SS\Medicare taxes increased on the same amount and have guarantee SS and free (or all almost free) health insurance after retirement. This is basically European model ( and as far as I know Canada is close to it)